We're upgrading the UTA borrowing experience with a new Manual Borrow feature, giving you greater control and flexibility when trading on margin. The feature is expected to go live on 15 October 2025 (launch time may vary). Below, we highlight the key changes you need to know.

Liabilities

Before the upgrade, all liabilities in the Unified Trading Account were treated as a single combined balance. After the upgrade, they will be separated into Spot liabilities and Derivatives liabilities. This distinction affects how repayments are handled.

Spot Liabilities

Includes borrowed amounts from Spot Margin Trading or Manual Borrow, plus any accrued interest.

Derivatives Liabilities

Includes borrowed amounts from Derivatives trading, such as:

- Unrealized & realized P&L from Perpetual & Expiry contracts

- Trading fees and funding fees

- Interest from Derivatives borrowing

- Decrease in Options value

- Options premiums

Overview: UTA Loan in Spot Margin Trading

Feature | Before Upgrade | After Upgrade |

Manual Borrow | Not supported | Supported |

Auto Borrow (Spot Margin Trading) | Supported | Supported |

Single-Coin Repayment | Only full repayment (borrowed coin OR full conversion) is supported.

Partial/mixed repayment is not available. | Full, partial and mixed repayments (borrowed coin + conversion) are supported. |

Repay All | Supported. The system only converts collateral assets for repayment. | Supported. The system uses available borrowed coin first, then collateral assets. |

Renew | Not Supported | For Fixed Rate Loan Only If repayment is made before the due date, you may apply for a renewal and continue borrowing until the final maturity date. |

Auto Repayment by Transfer In (to UTA) | Can be used to repay both Spot and Derivatives liabilities. | Can be used to repay Derivatives liabilities only. |

Auto Repayment by Spot Trading | Can be used to repay both Spot and Derivatives liabilities. | Can be used to repay Derivatives liabilities only. |

Liability Types | No distinction between Spot and Derivatives liabilities. | Spot liabilities: Only manual repayment is supported.

Derivatives liabilities: Manual and auto repayments are supported. |

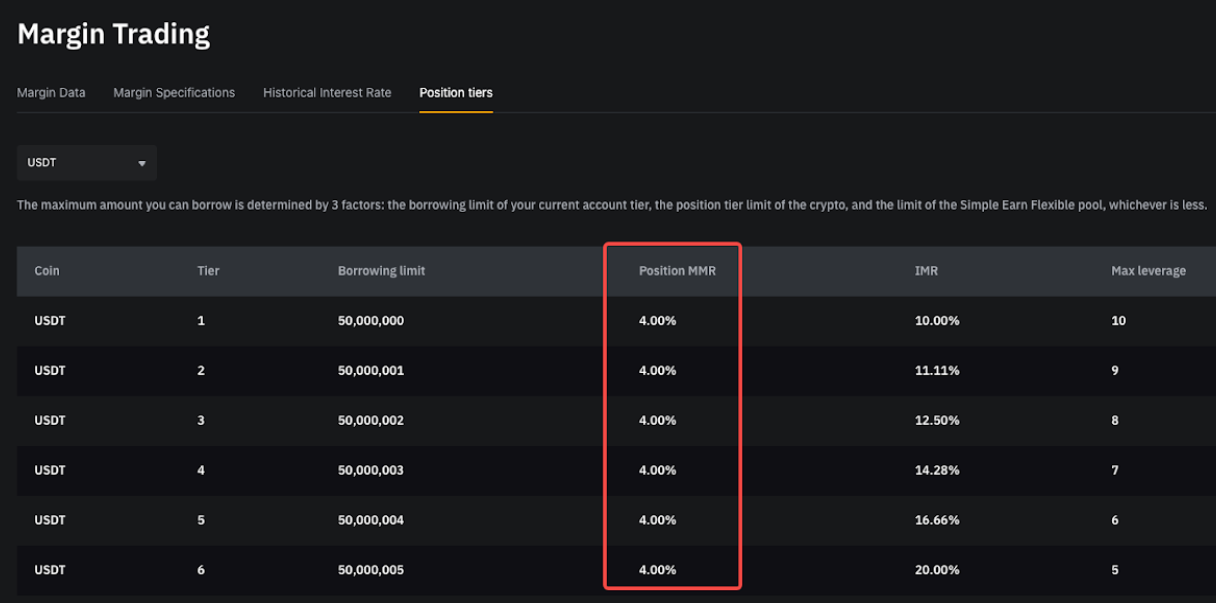

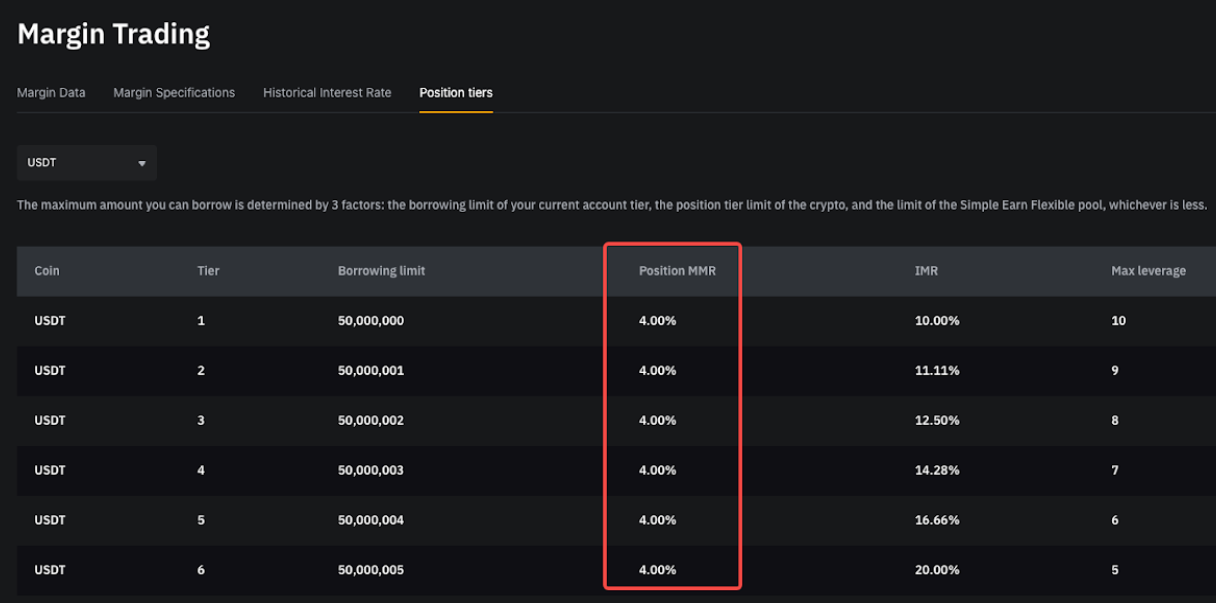

Max Leverage (Spot Margin) | 10x for all coins | Varies by coin |

Maintenance Margin Rate (MMR) | Fixed at 4% | Tiered MMR based on coin and borrowing amount.

For more details, please refer to the position tiers here. |

Detailed Feature Changes

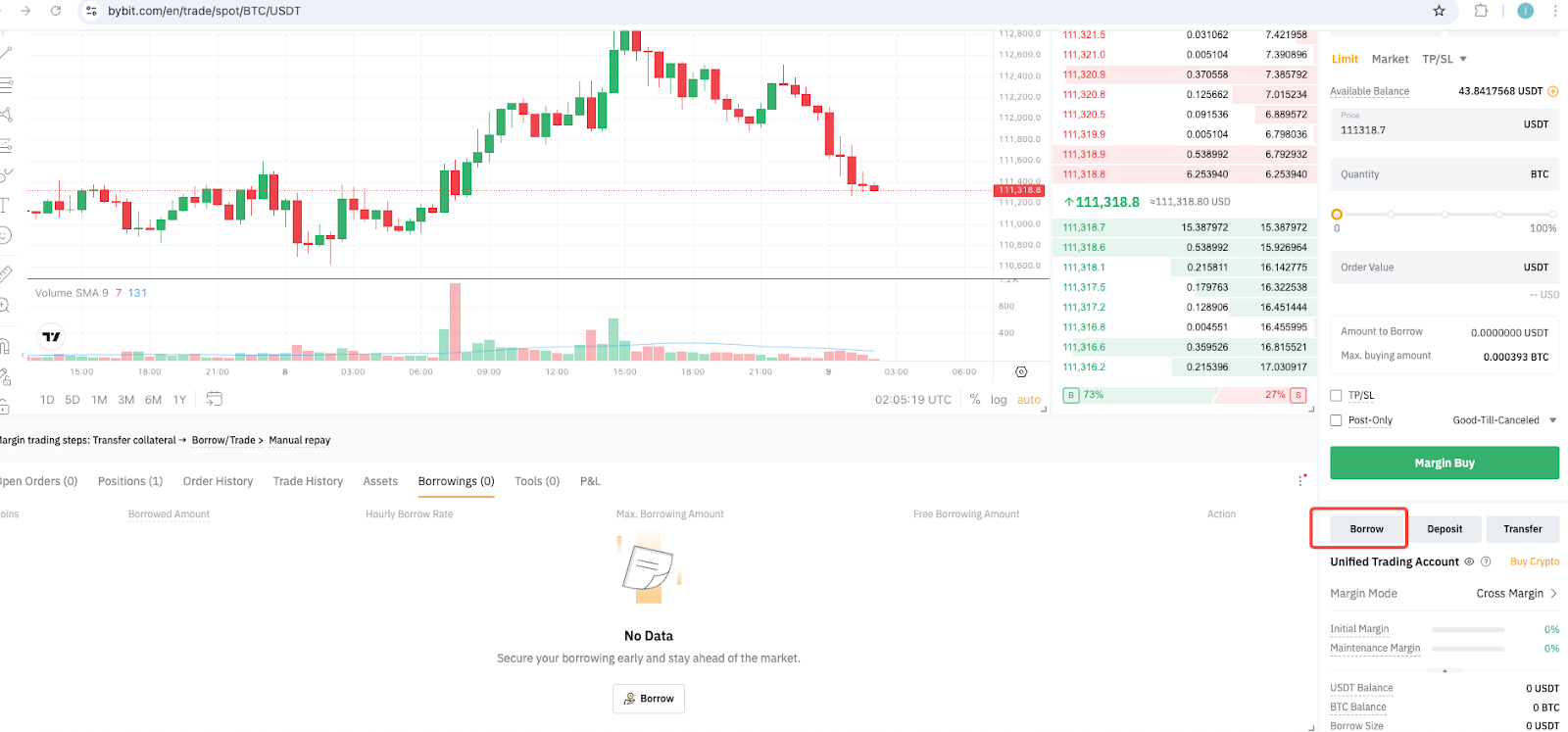

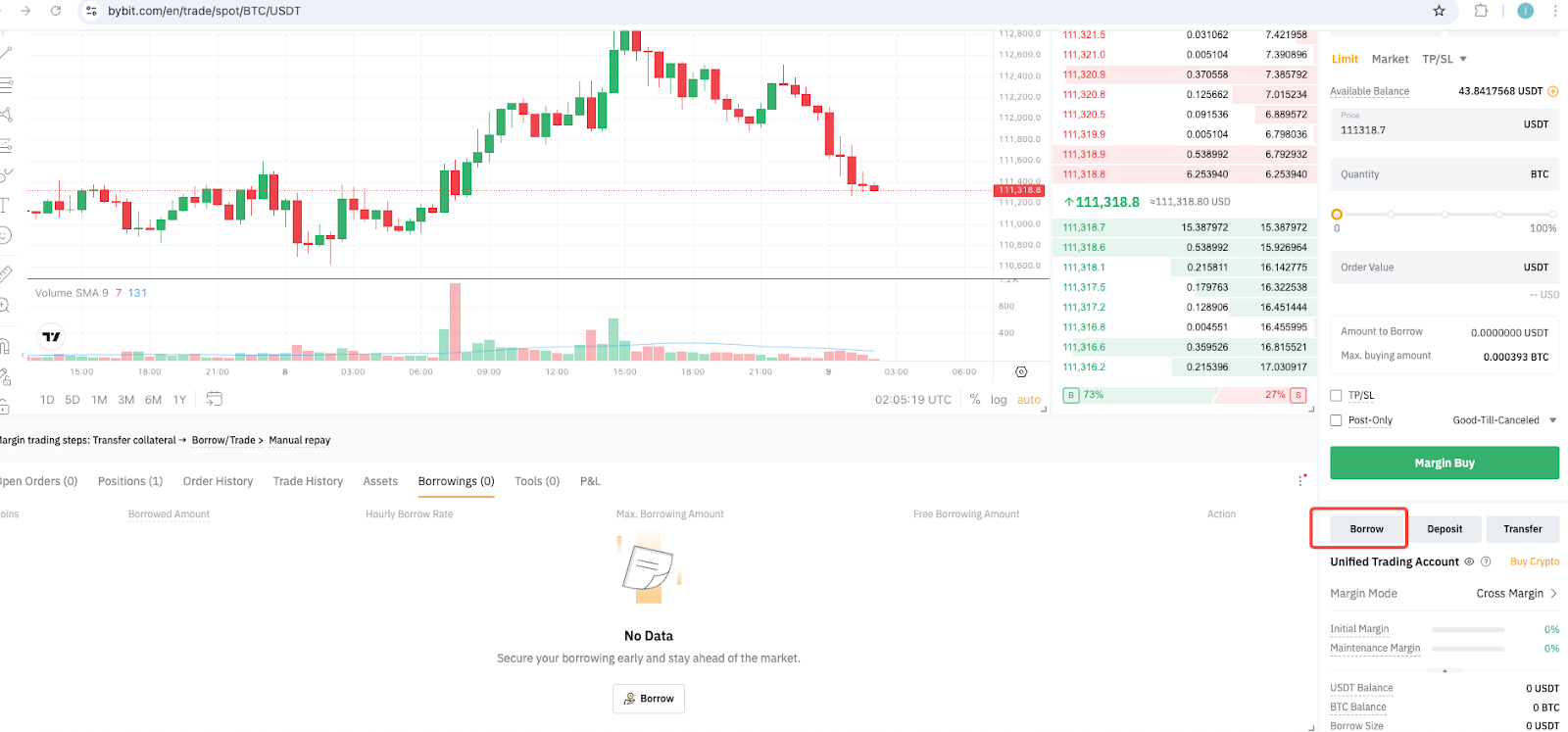

Spot Margin Trading — Manual Borrow

Before Upgrade | After Upgrade |

Not supported | Supported on the Spot Margin page or Asset page.

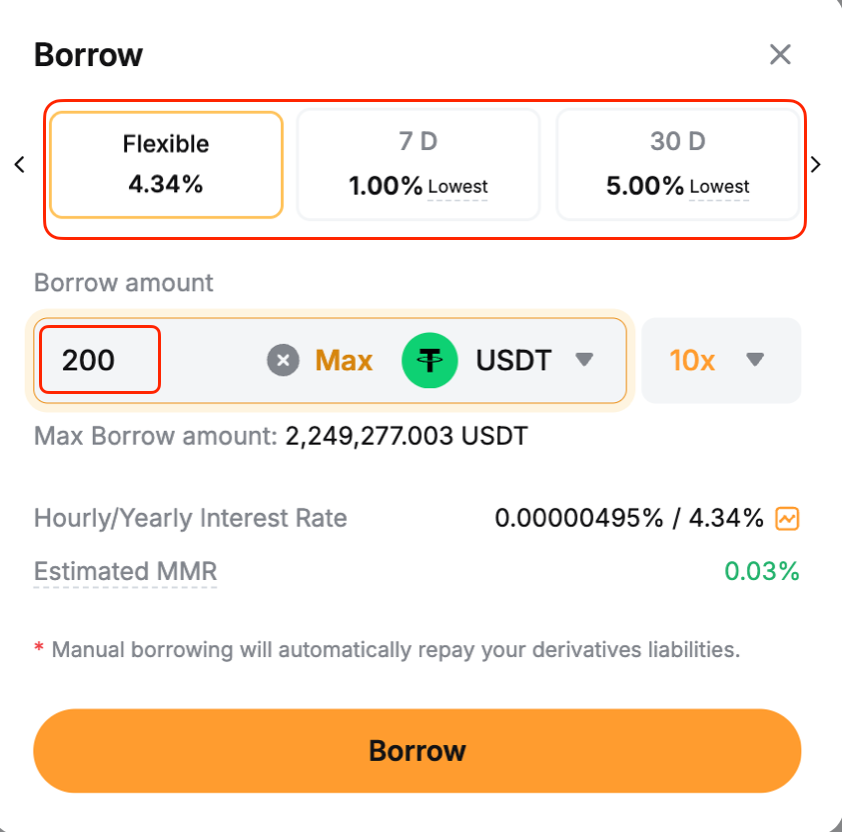

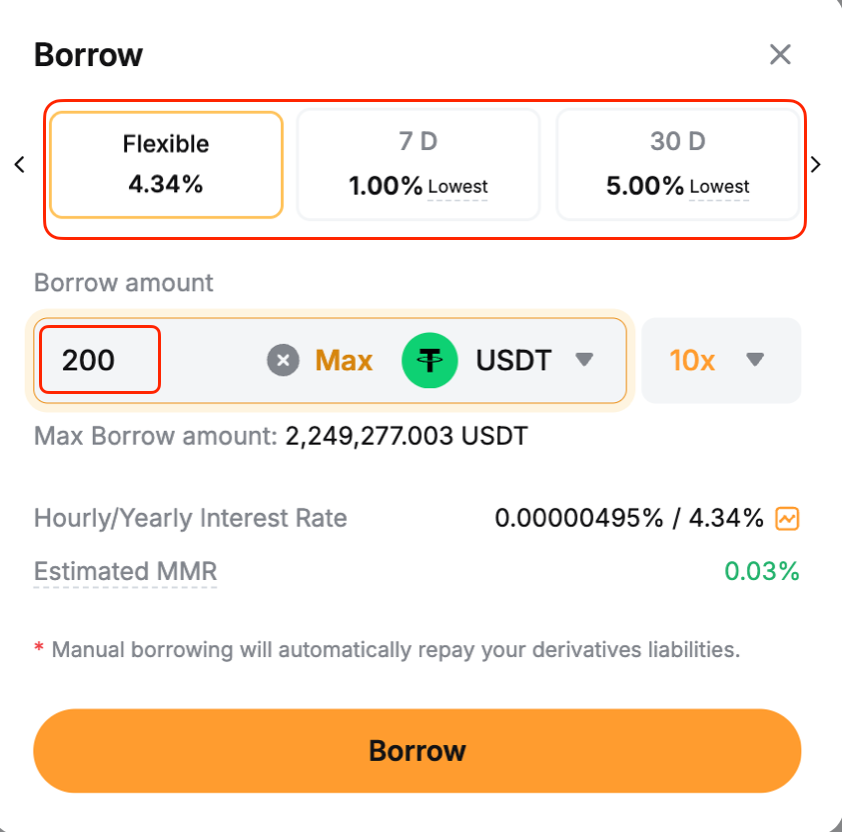

To make a manual borrowing: Step 1: Click Borrow.

Step 2: Select the loan type (Flexible or Fixed) and enter the amount. Click Borrow to confirm.

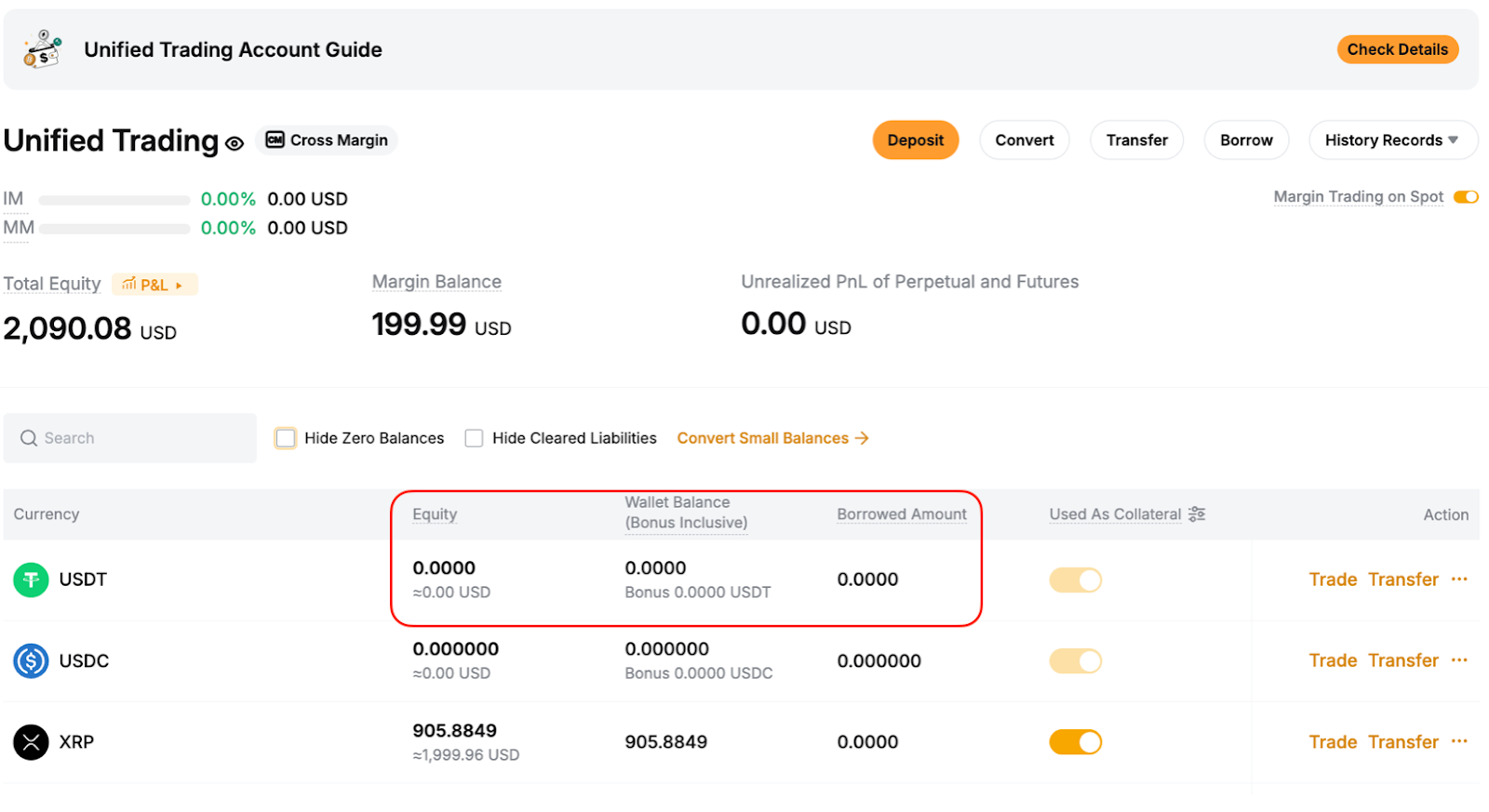

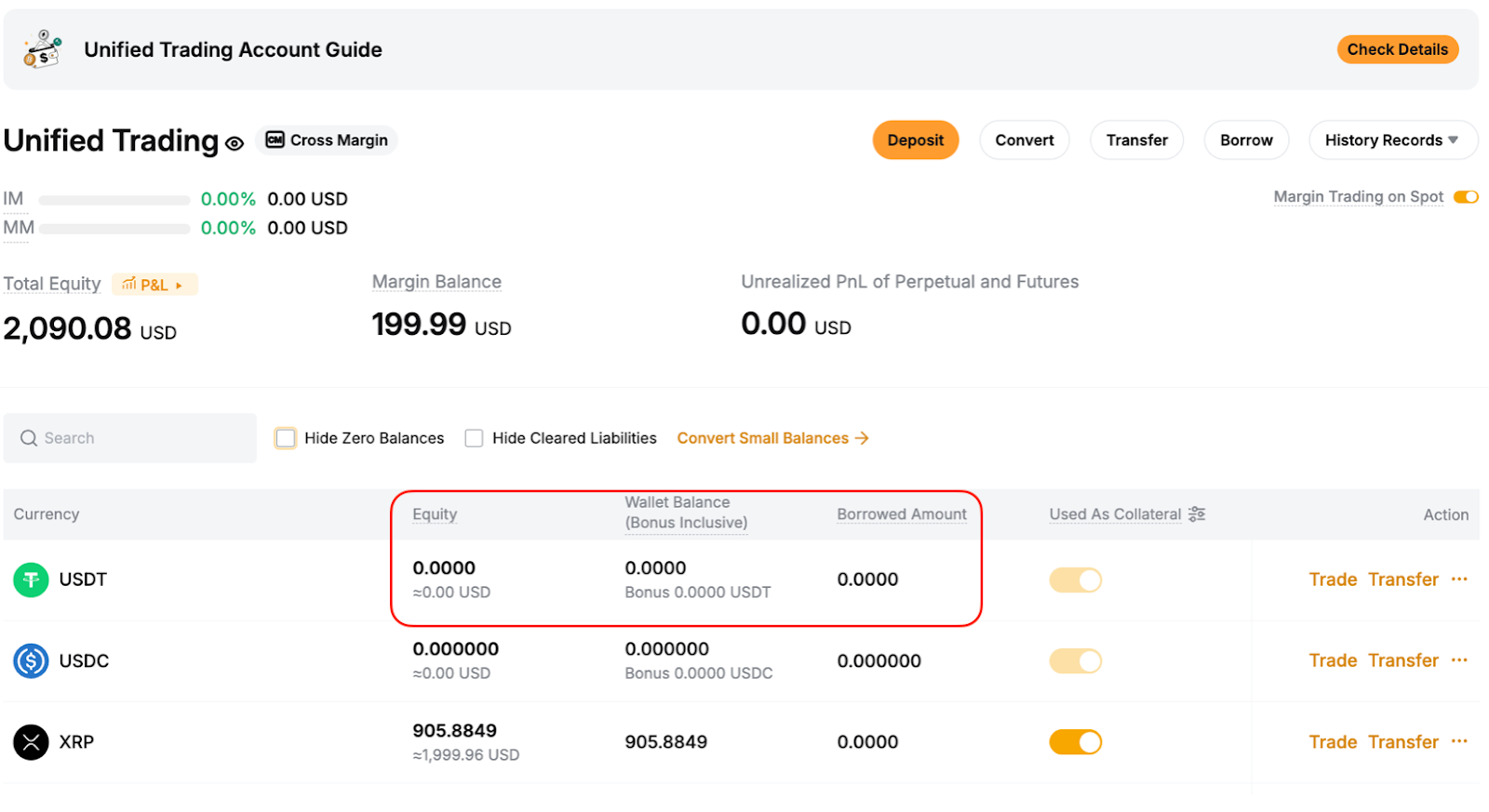

Example Before borrowing: - USDT equity = 0

- Wallet balance = 0

- Borrowed amount = 0

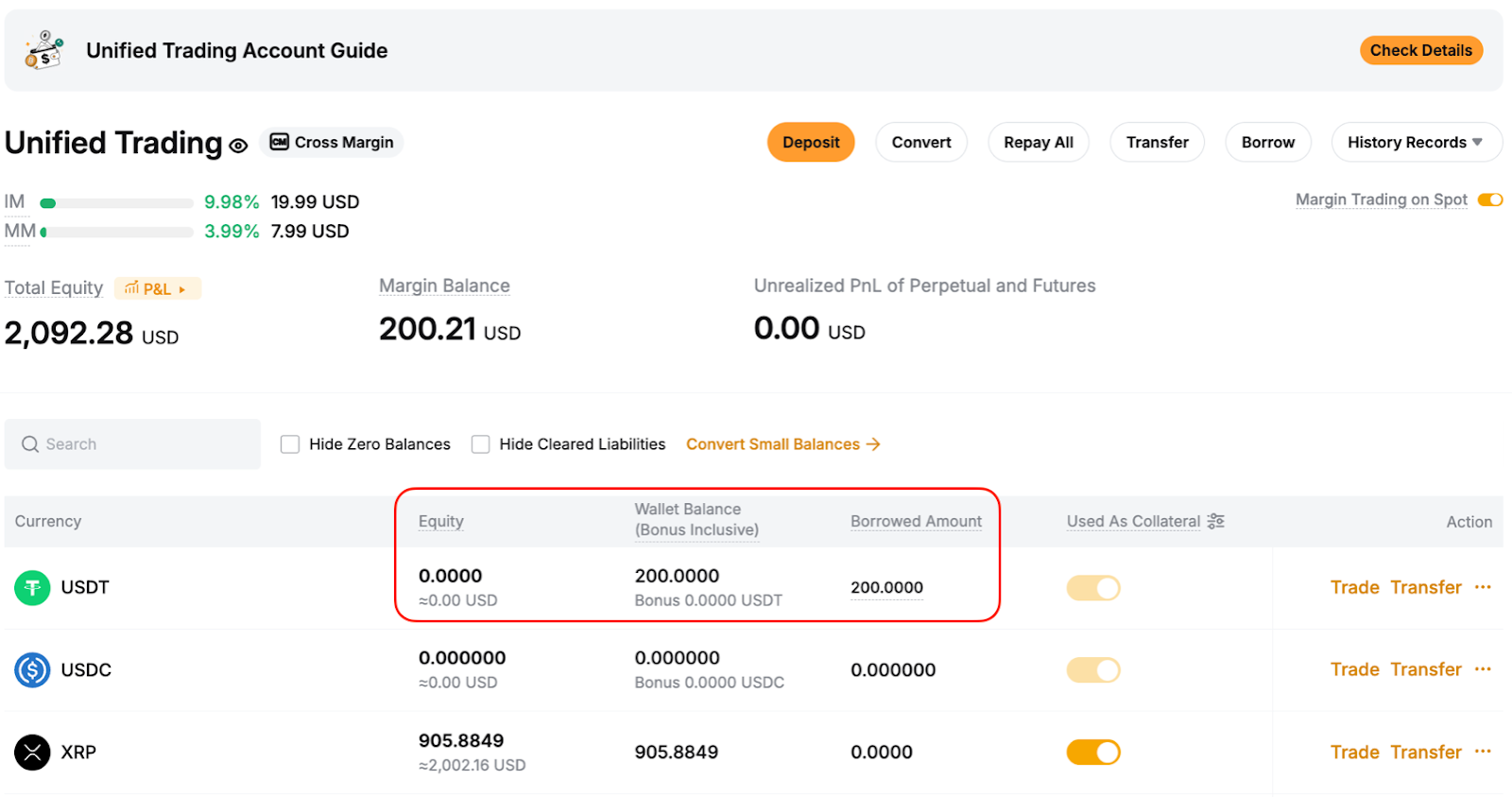

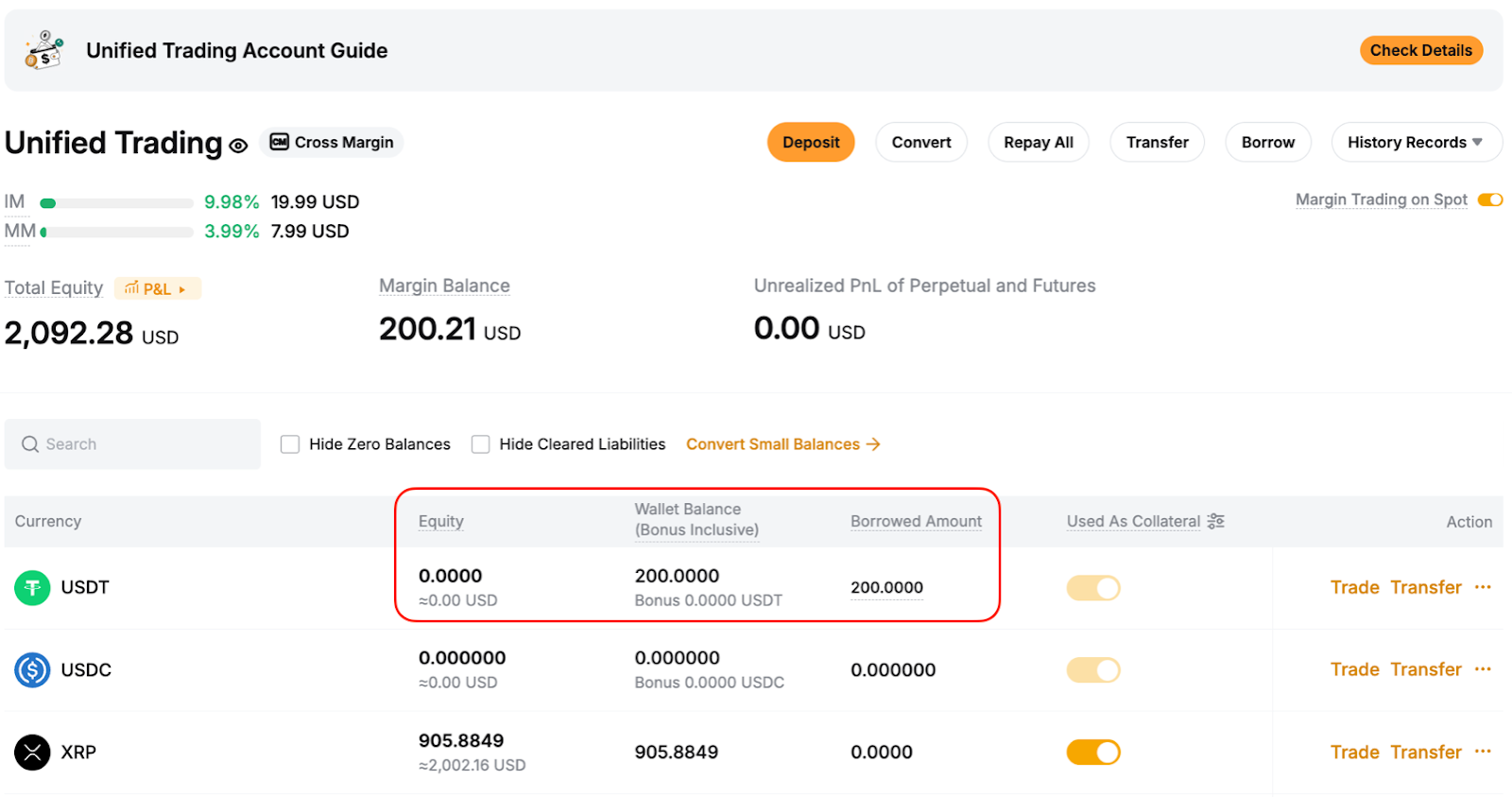

After borrowing 200 USDC: - USDT equity = 0

- USDT wallet balance = 200

- Spot liabilities (borrowed amount) = 200

|

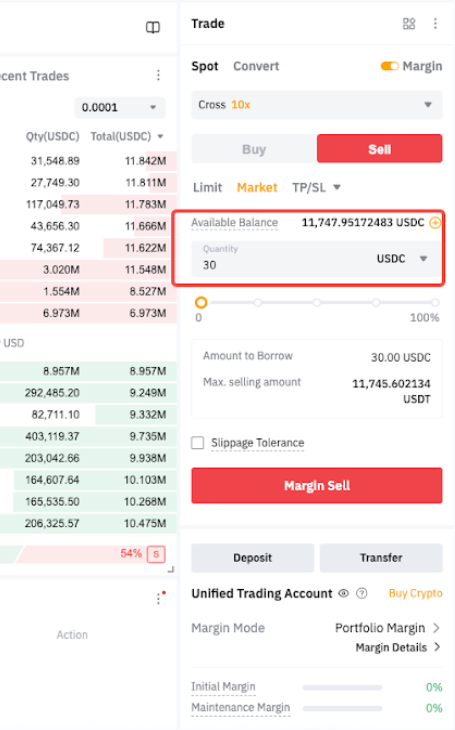

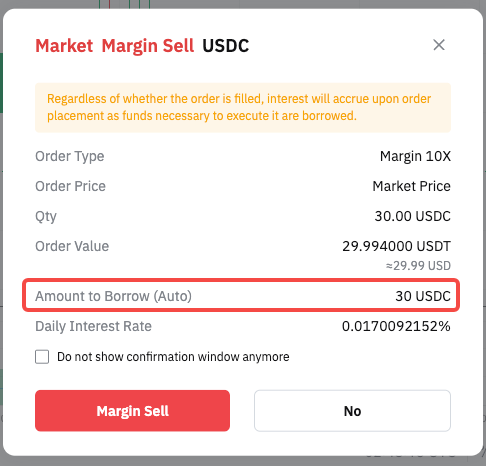

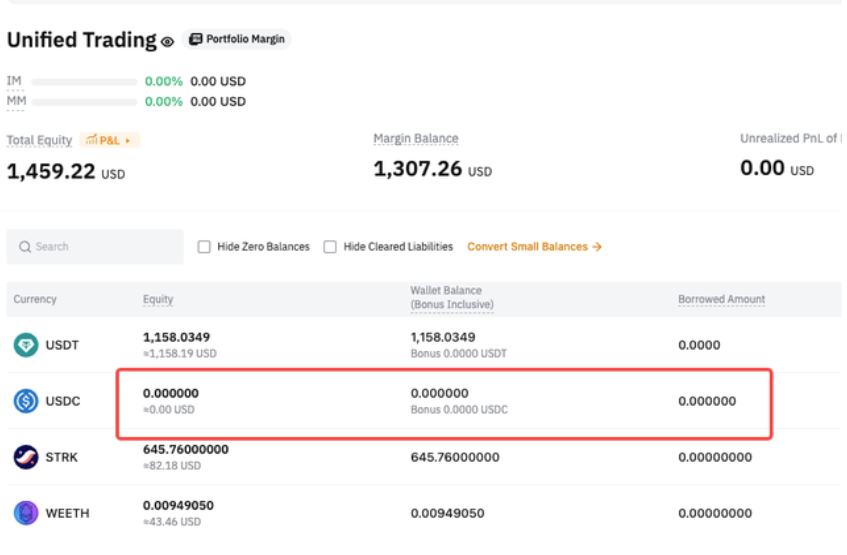

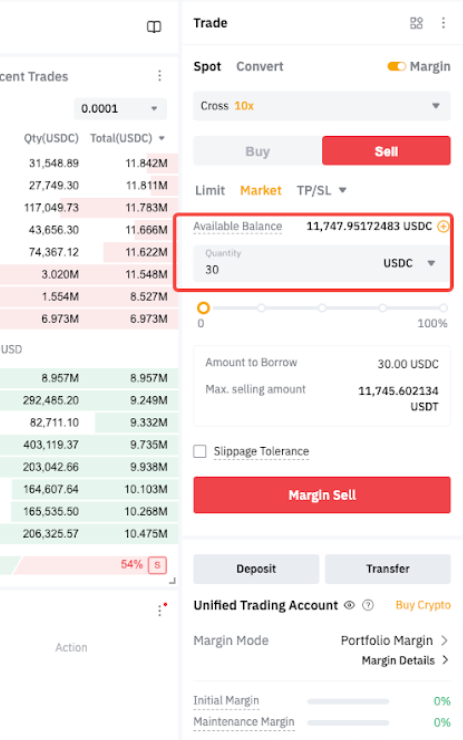

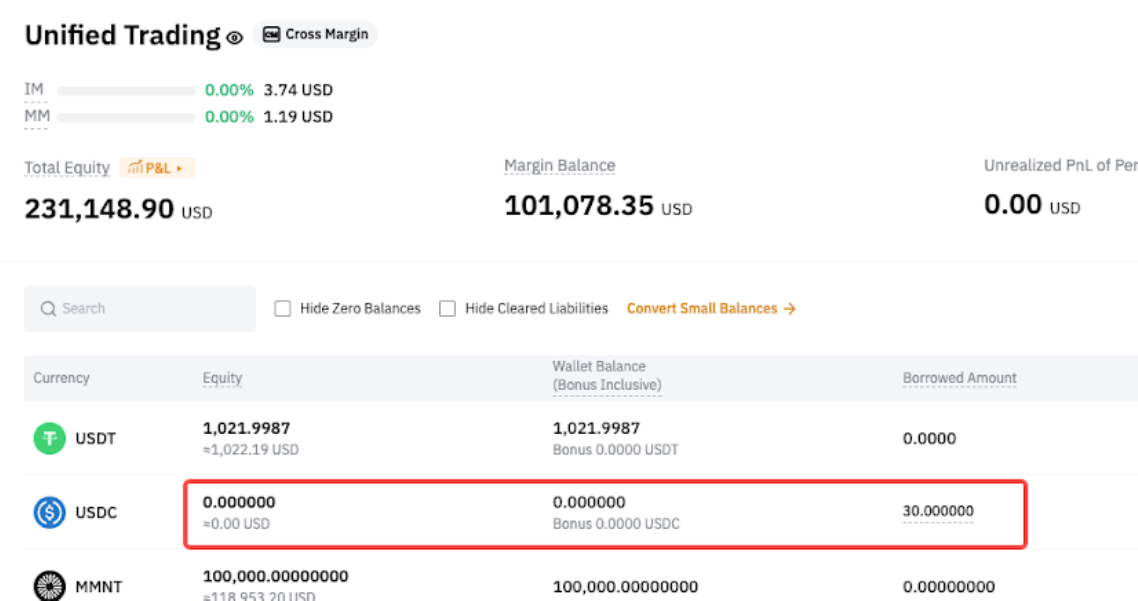

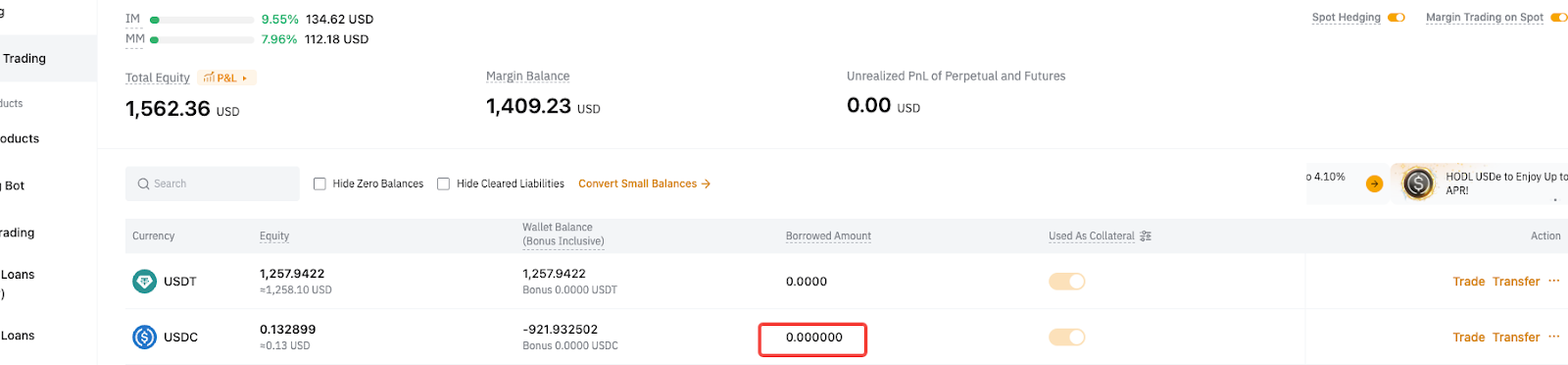

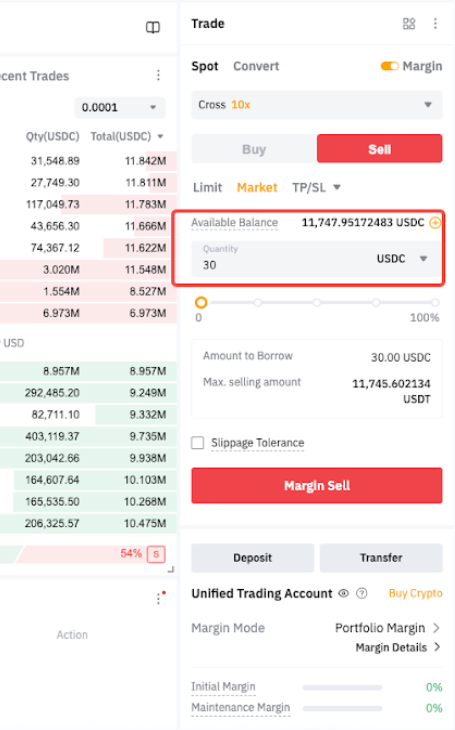

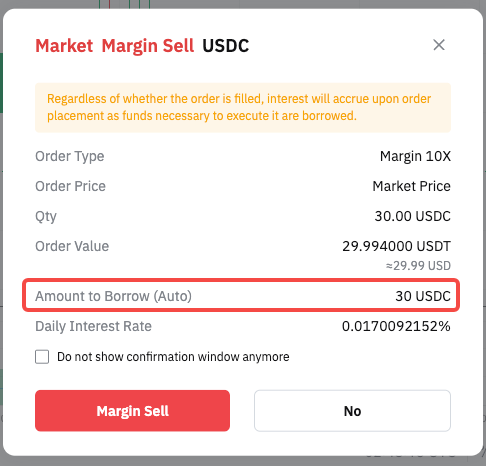

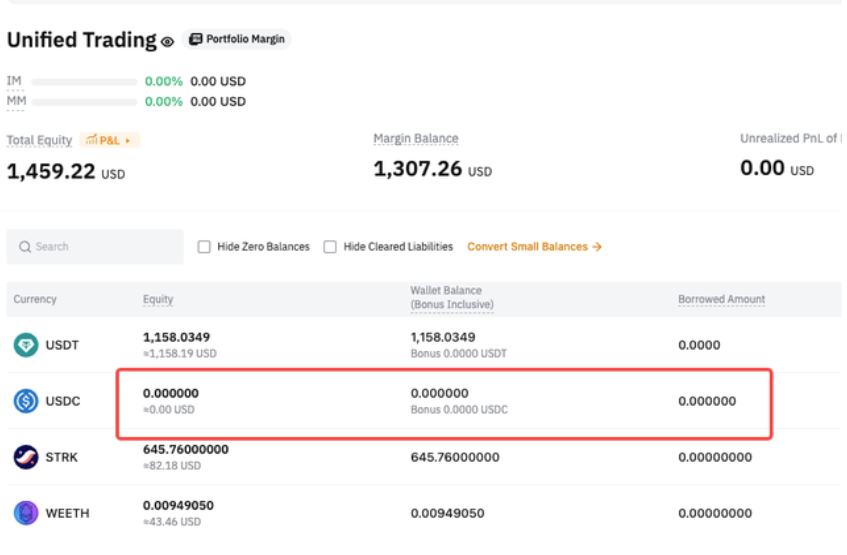

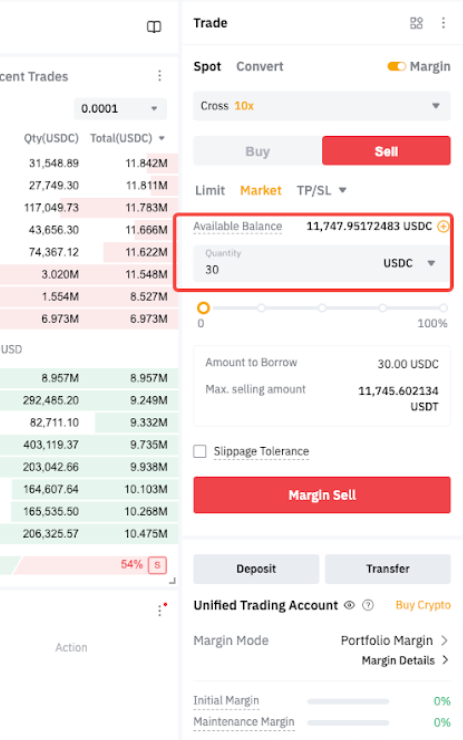

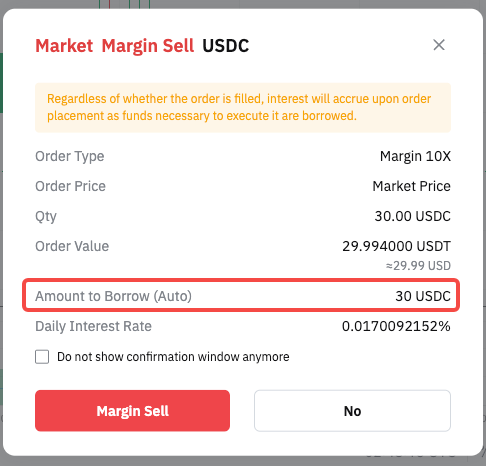

Spot Margin Trading — Auto Borrow

Before Upgrade | After Upgrade |

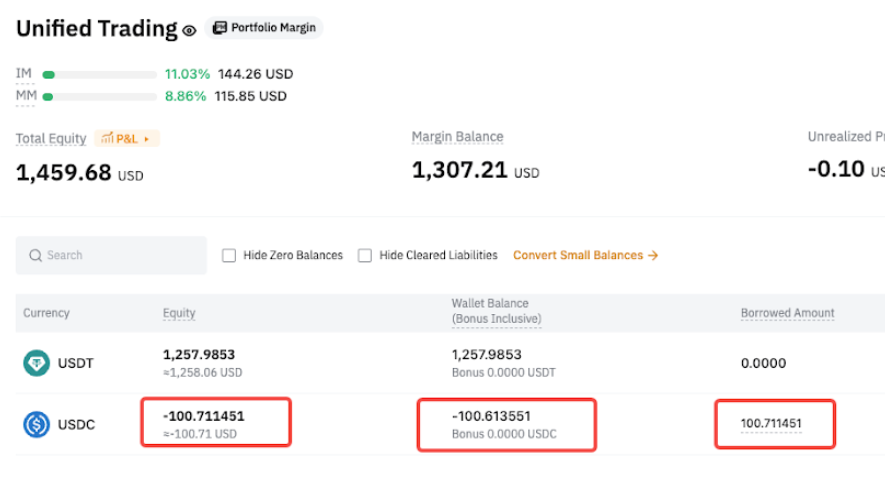

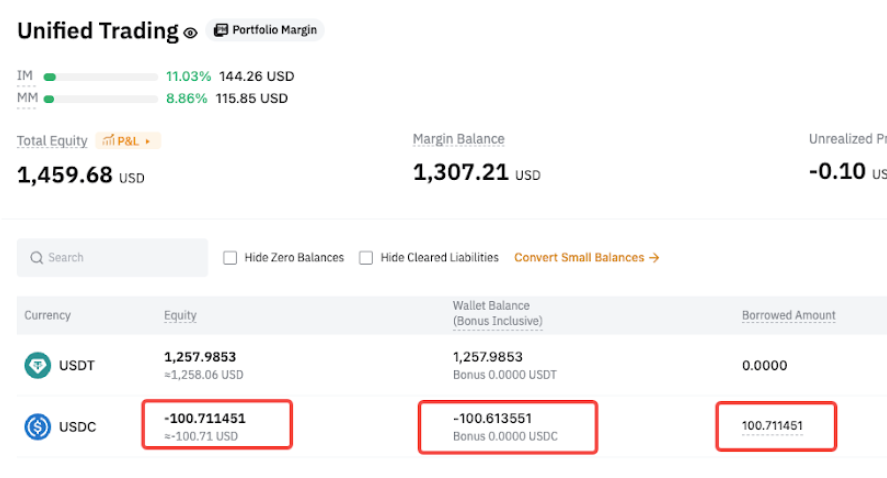

Supported. The wallet balance shows a negative amount, and the borrowed amount is recorded.

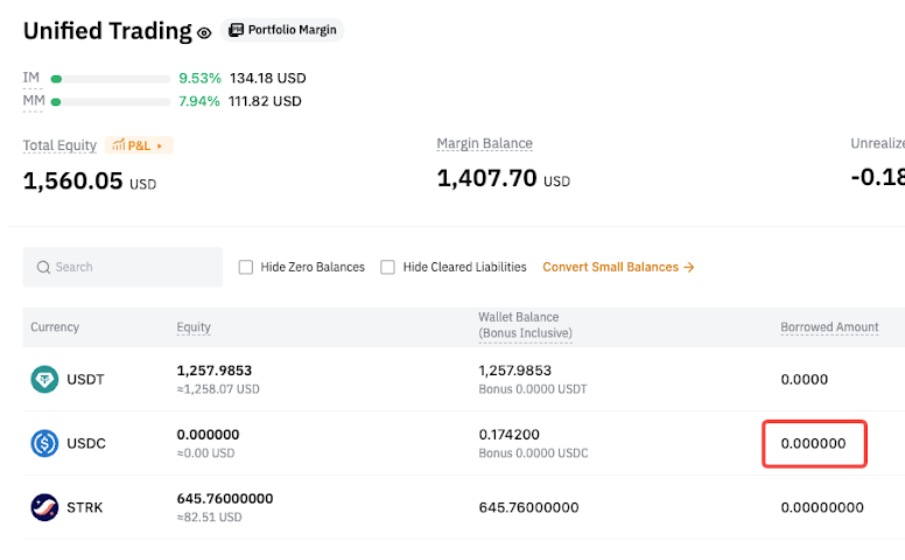

Example You place a Spot Margin order that is filled immediately. The system automatically borrows the required amount. | Supported. The wallet balance shows zero, and the borrowed amount is recorded.

Example You place a Spot Margin order that is filled immediately. The system automatically borrows the required amount. |

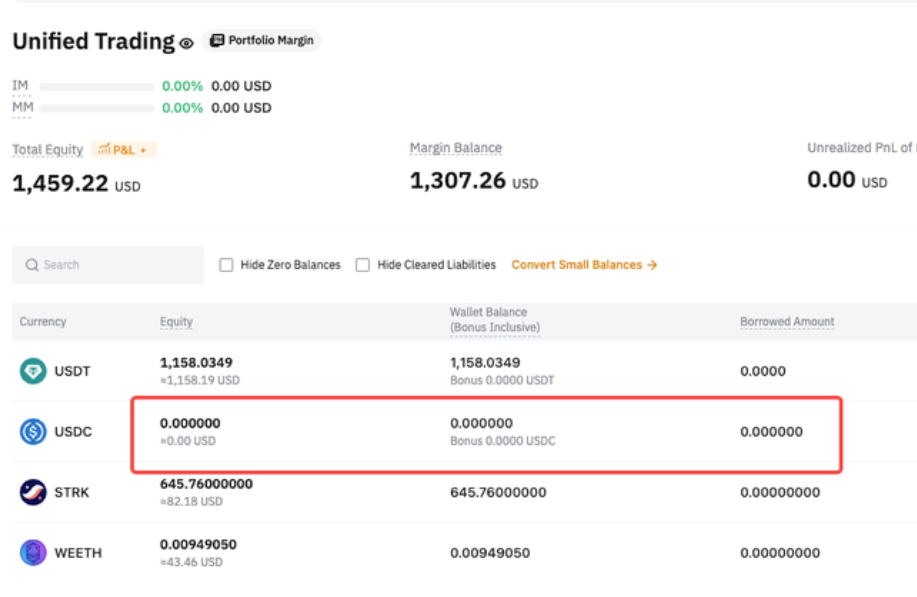

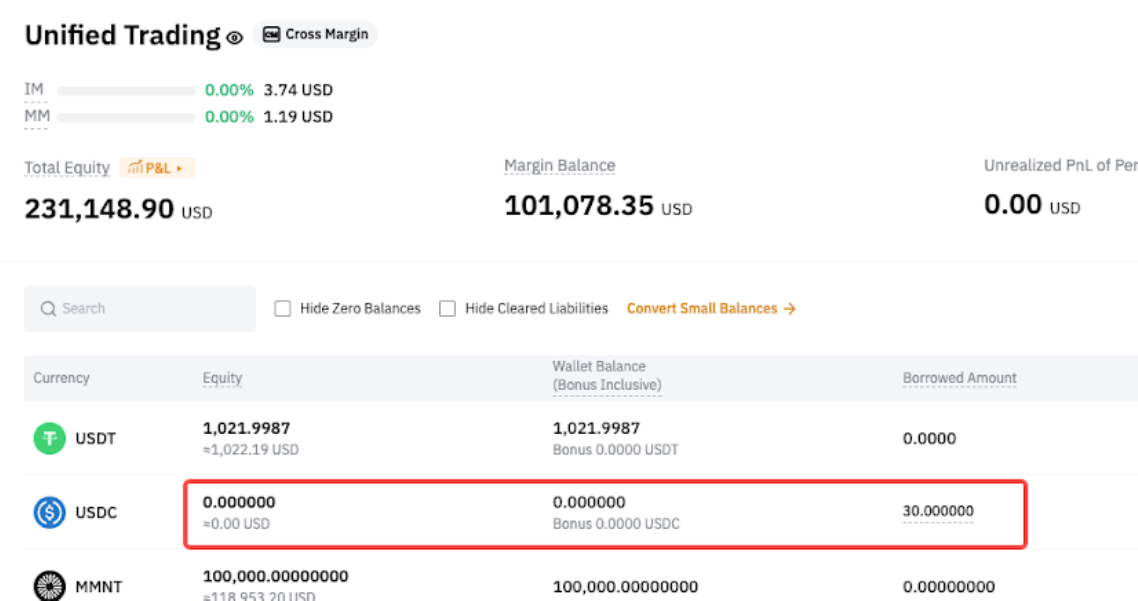

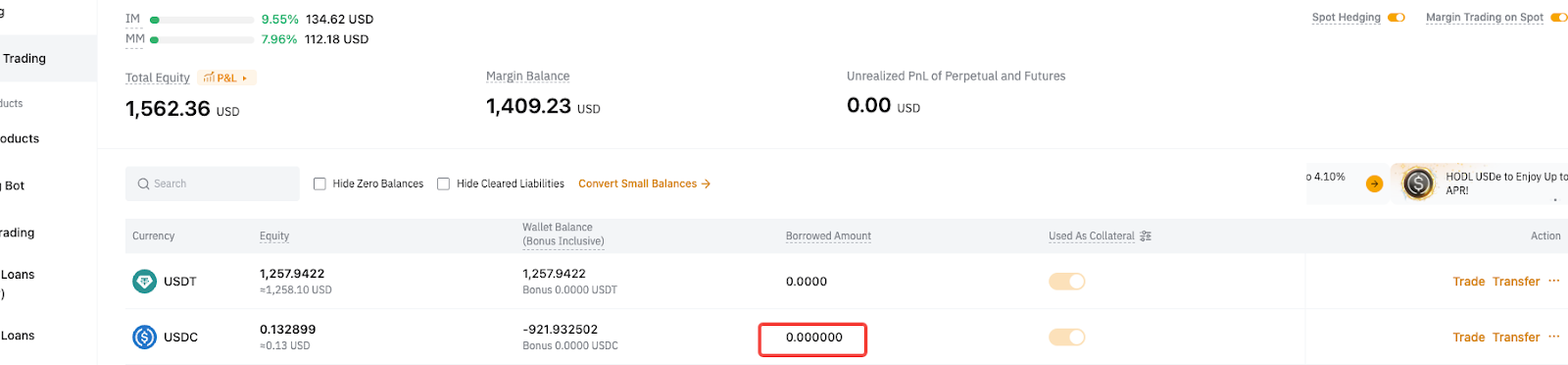

Before borrowing: - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 0

After borrowing: - USDC equity = -30

- USDC wallet balance = -30

- USDC borrowed amount = 30

|

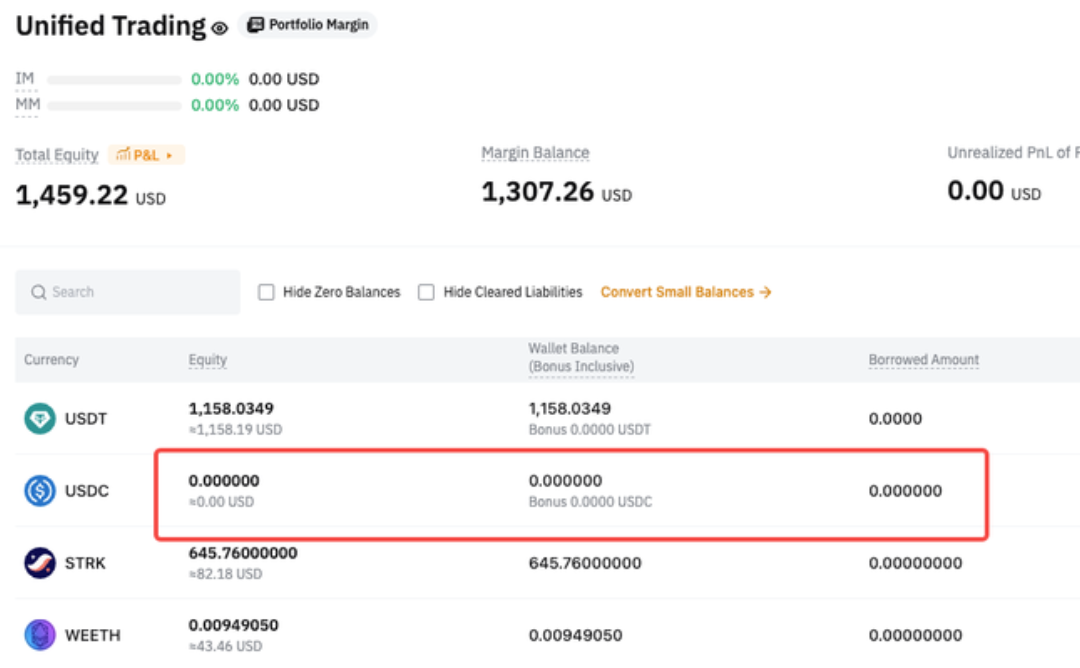

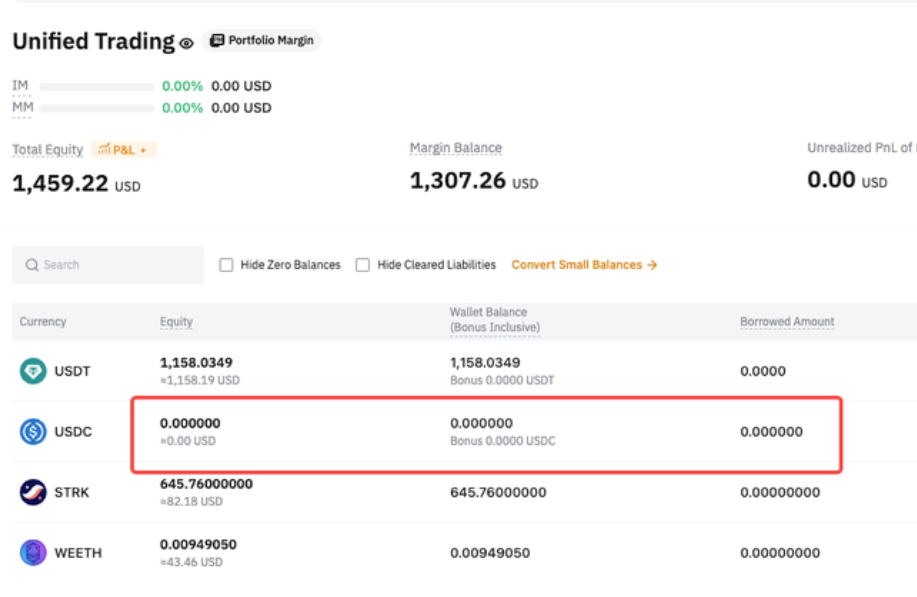

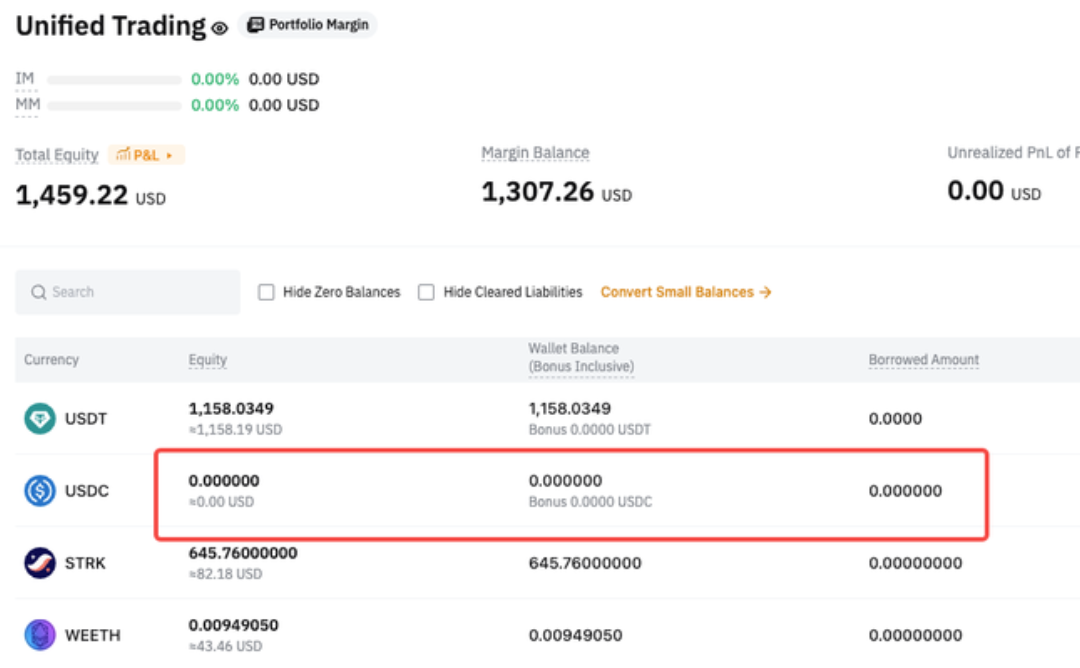

Before borrowing: - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 0

After borrowing: - USDC equity = -30

- USDC wallet balance = 0

- USDC borrowed amount = 30

|

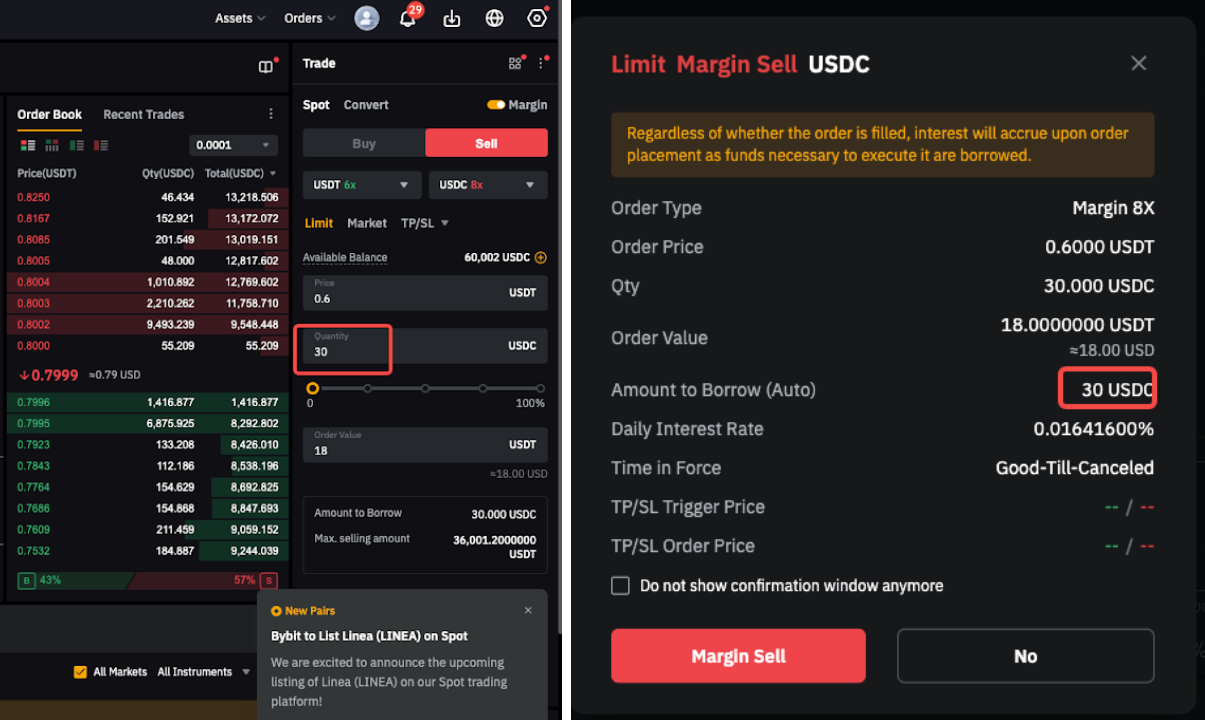

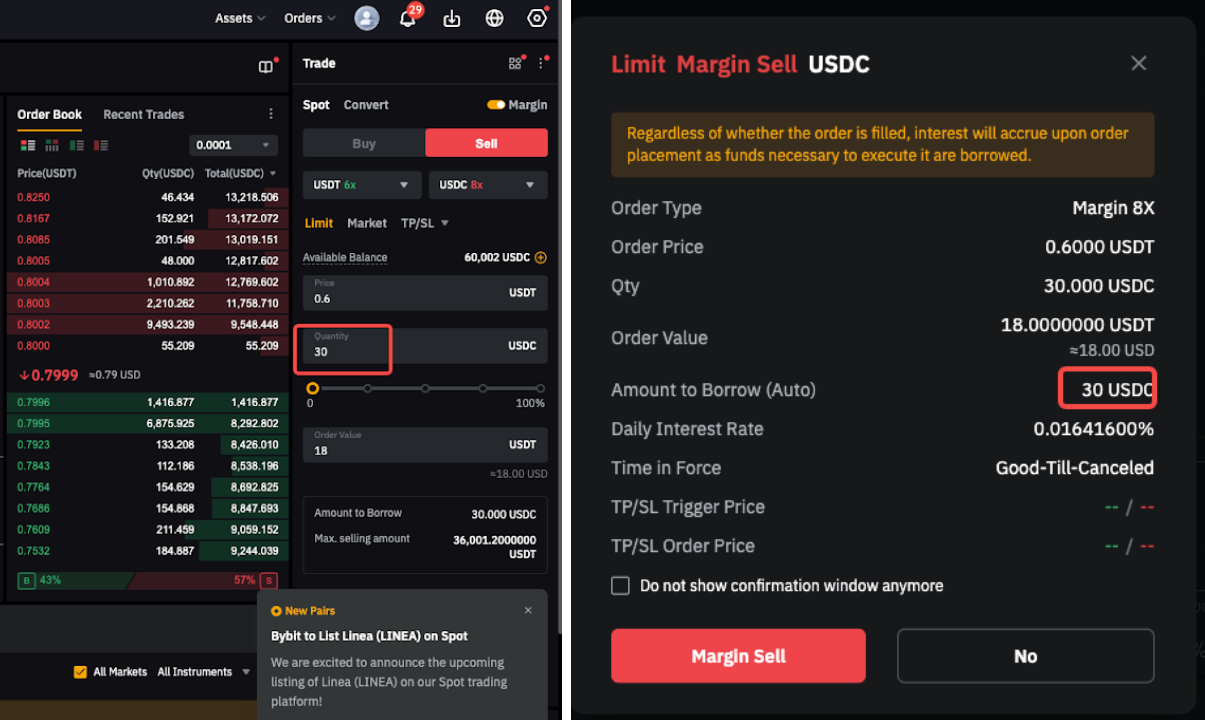

Spot Margin Trading — Limit Order Auto Borrow

Before Upgrade | After Upgrade |

Supported | Remains unchanged |

Example You place a Spot Margin limit order.

Before borrowing: - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 0

After borrowing: - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 30

|

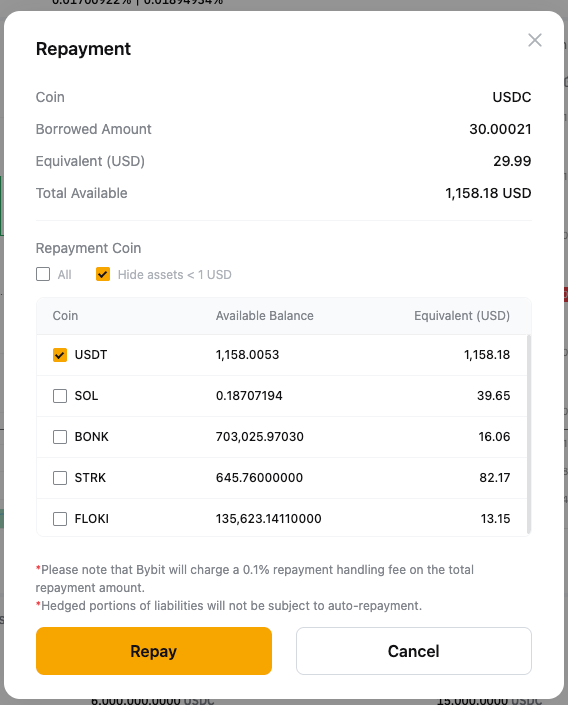

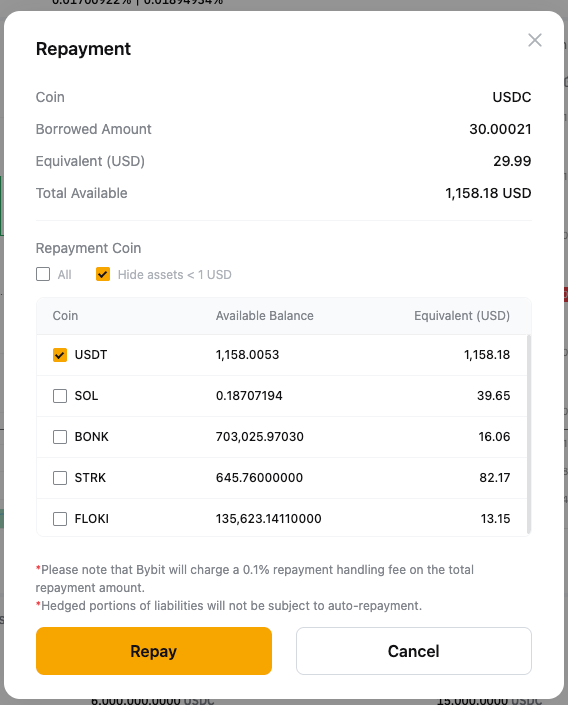

Single-Coin Repayment

Before Upgrade | After Upgrade |

- Only full repayment (using the borrowed coin or conversion) is supported.

- Partial or mixed repayment (borrowed coin + conversion) is not supported.

| Full and partial repayment (using borrowed coin) are supported. |

To make a single-coin repayment:

Step 1: Go to the Single-Coin Repayment page. Only full repayment is supported.

If you have insufficient borrowed coins, you can make a full repayment with other collateral assets. The system will convert collateral to repay the borrowed coins, and a 0.1% handling fee will apply. | To make a single-coin repayment:

Step 1: Go to the Single-Coin Repayment page. Both full and partial repayments are supported.

The system will use your available borrowed coin for repayment. |

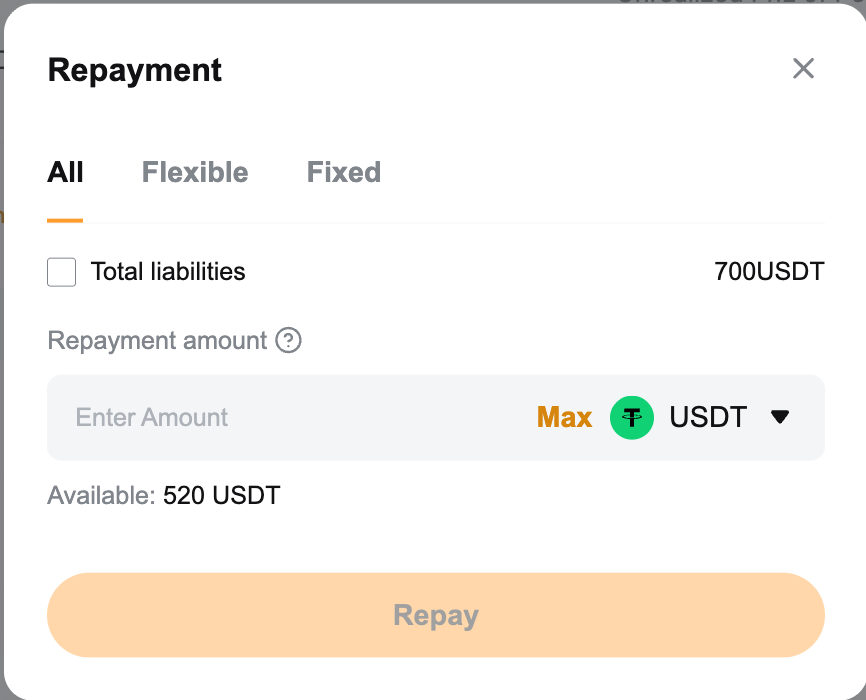

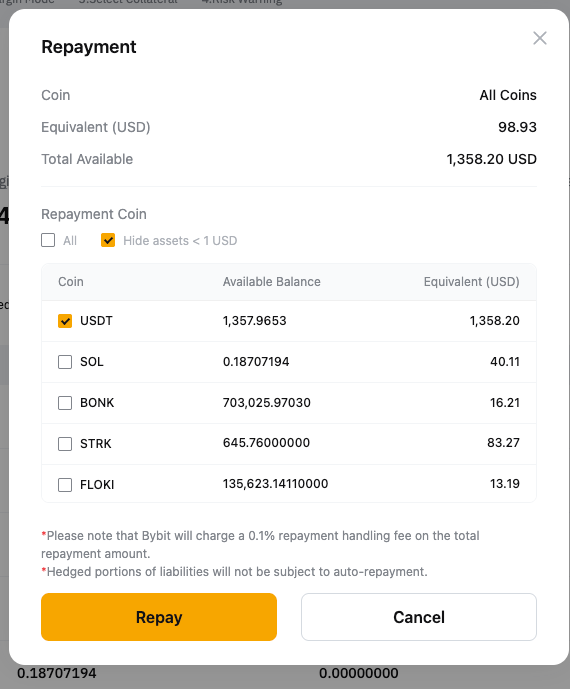

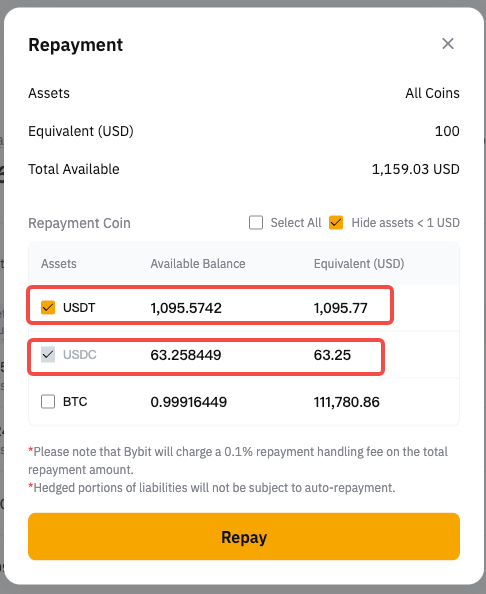

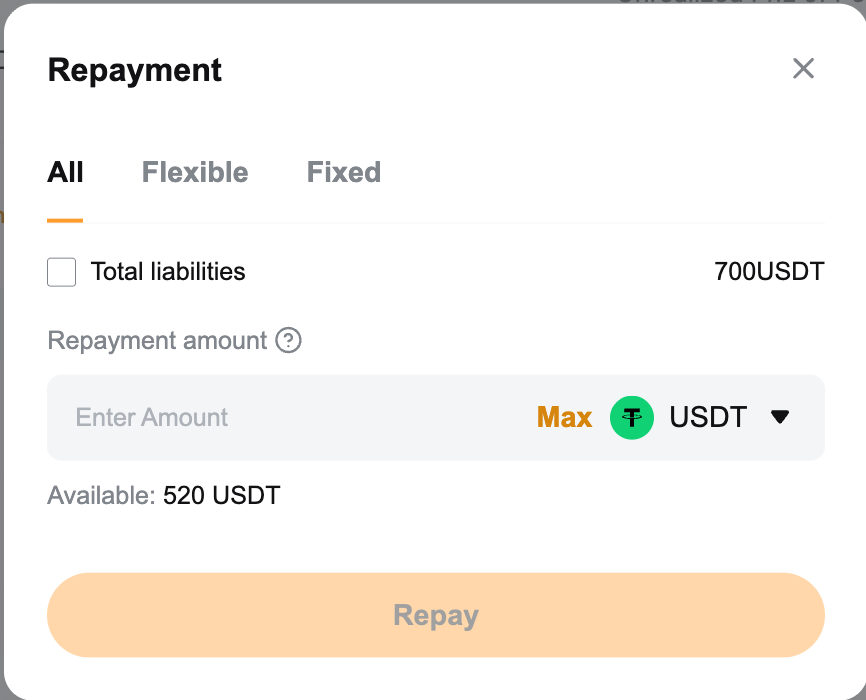

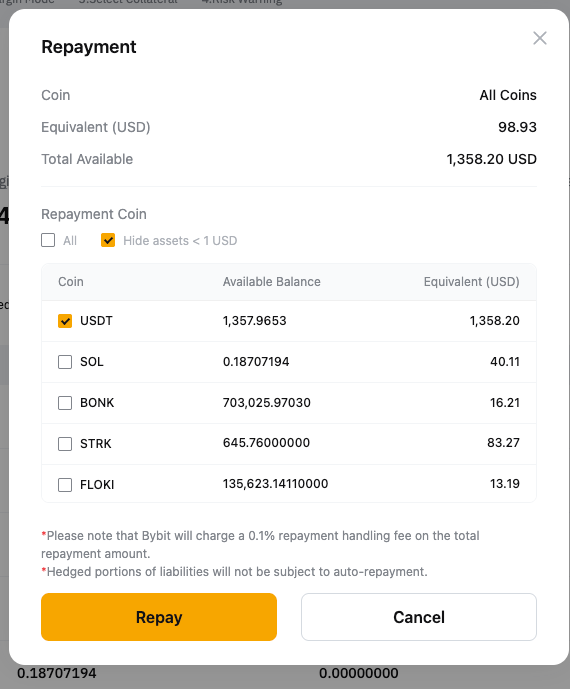

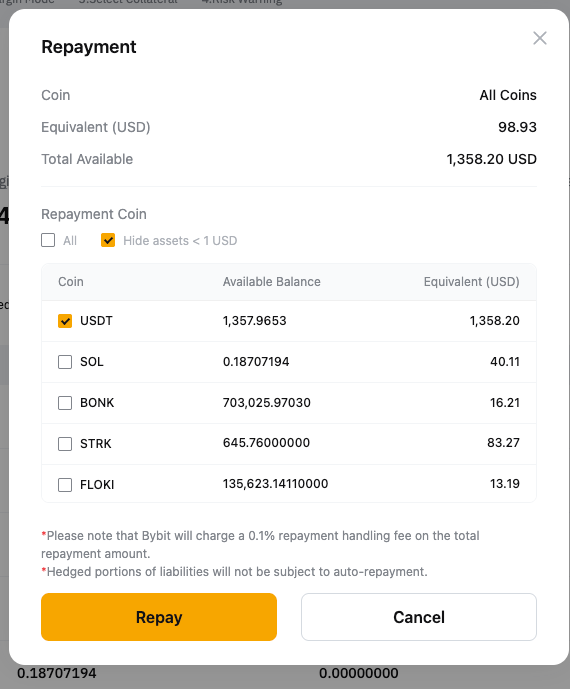

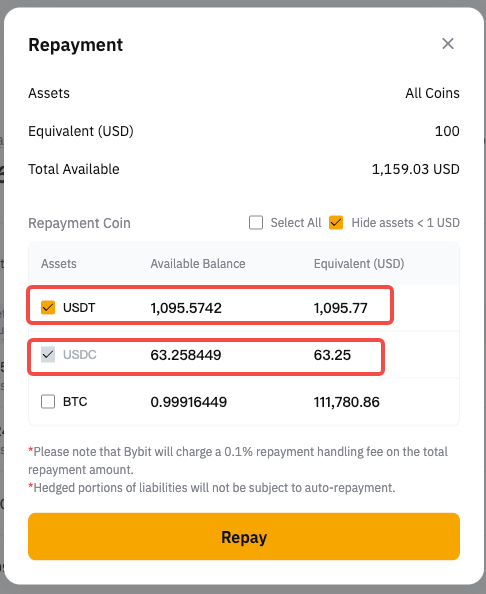

Repay All Liabilities

Before Upgrade | After Upgrade |

Converts collateral to repay borrowed coins. | Uses available borrowed coin first, then converts collateral. |

Step 1: Click Repay All, then select the collateral coin for repayment.

Step 2: The system will convert the selected collateral into the borrowed coin to repay your liabilities.

| Step 1: Click Repay All, then select the coin for repayment.

Step 2: The system will first use your available borrowed coin for repayment. Any remaining amount will be covered by converting your collateral into the borrowed coin.

|

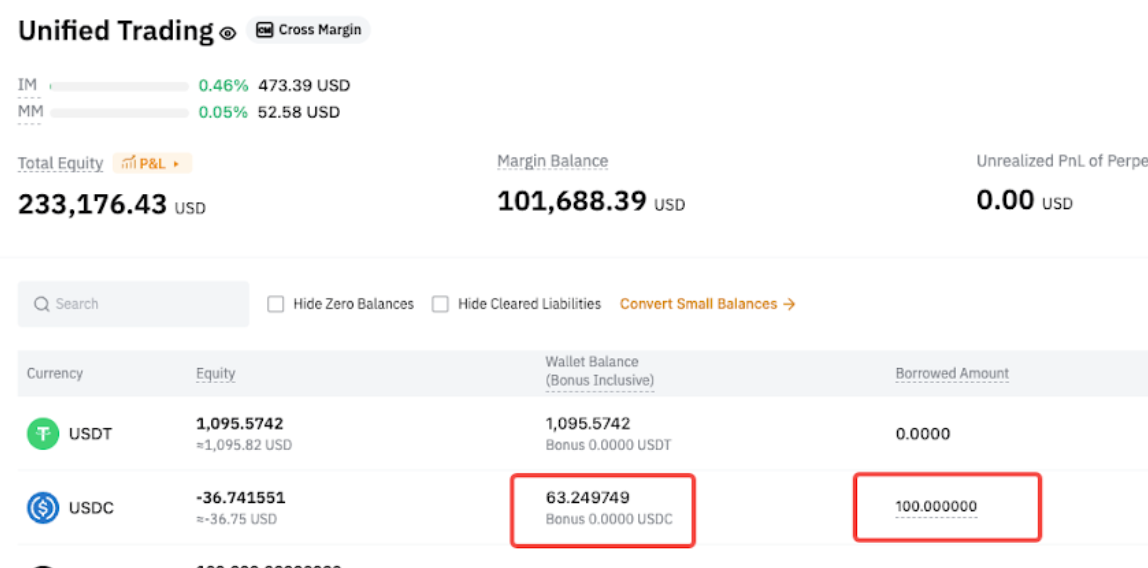

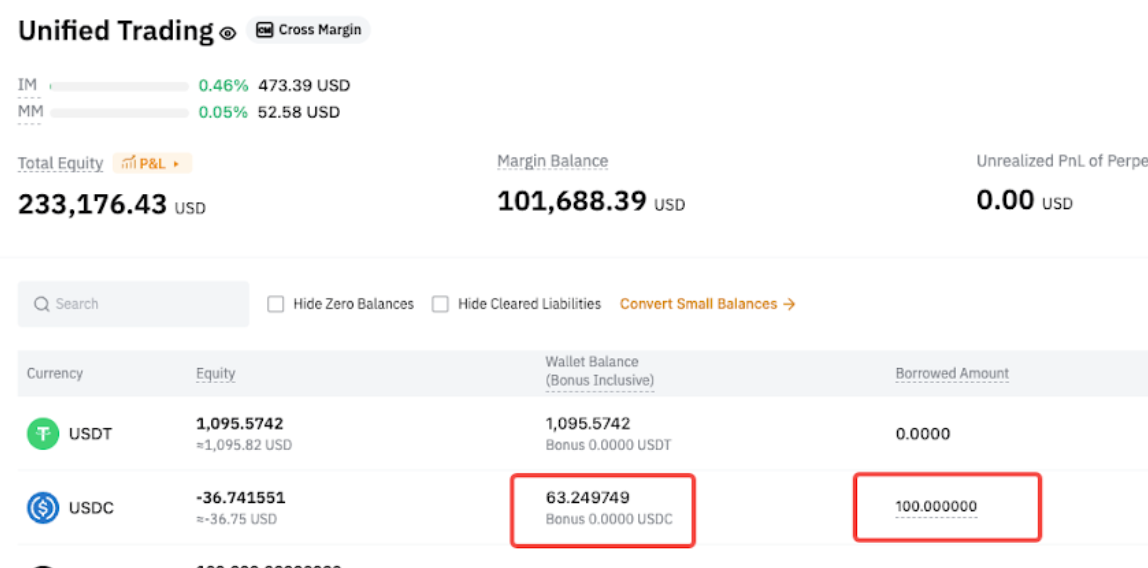

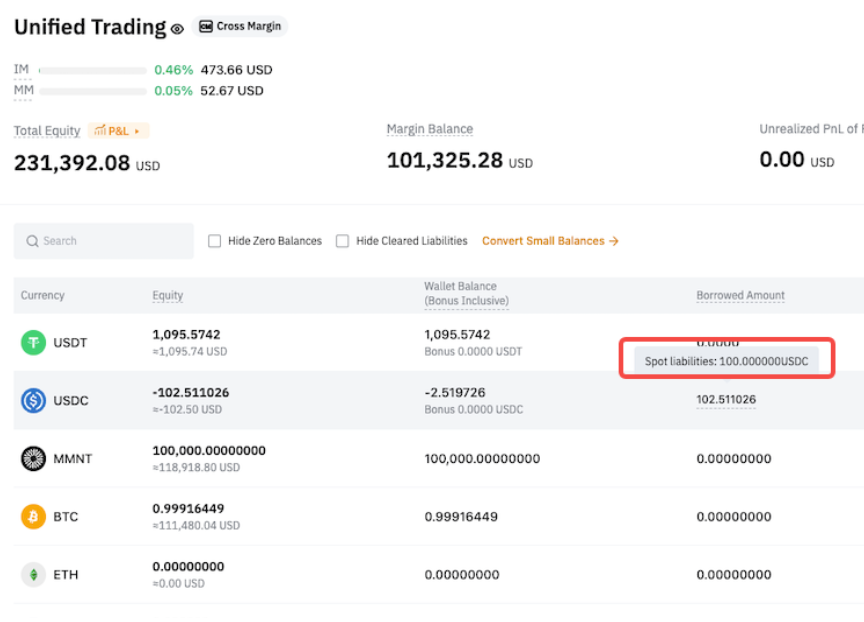

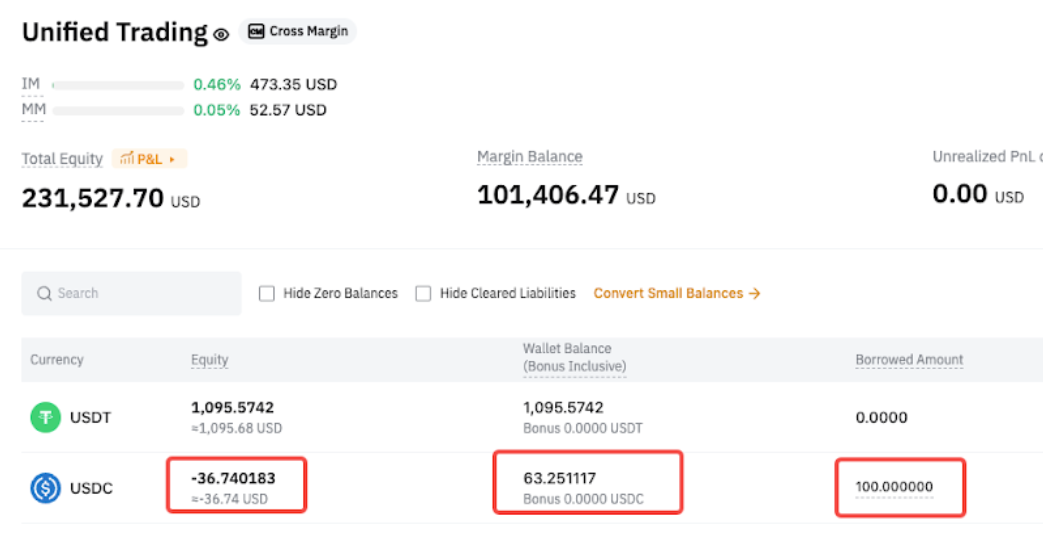

Repayment by Transfer In

Before Upgrade | After Upgrade |

Transfer-in coins are used to repay both Spot and Derivatives liabilities. | Transfer-in coins are used to repay Derivatives liabilities only. Spot liabilities remain outstanding and must be repaid manually. |

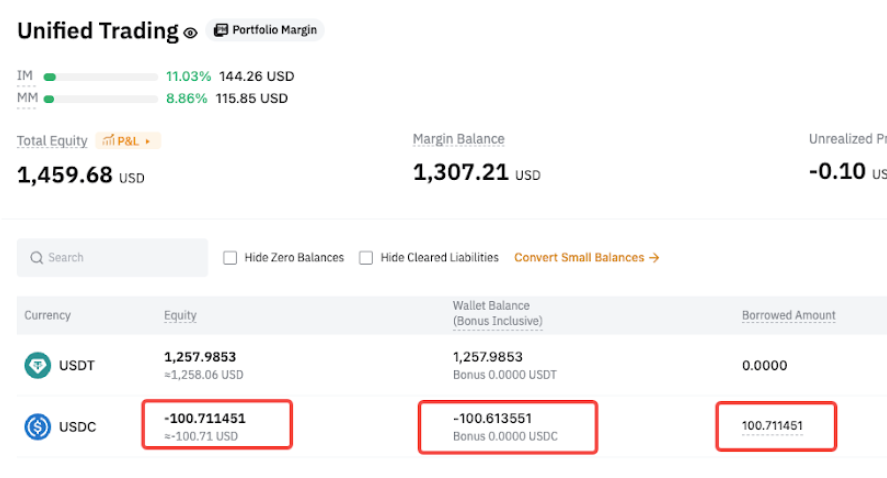

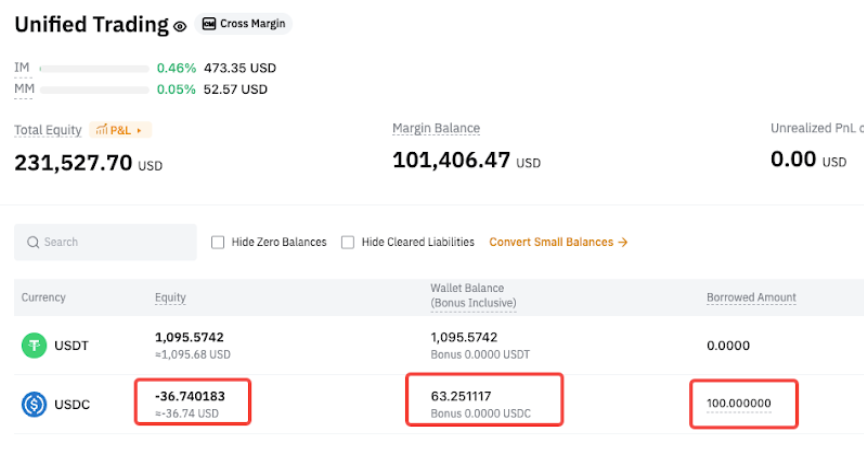

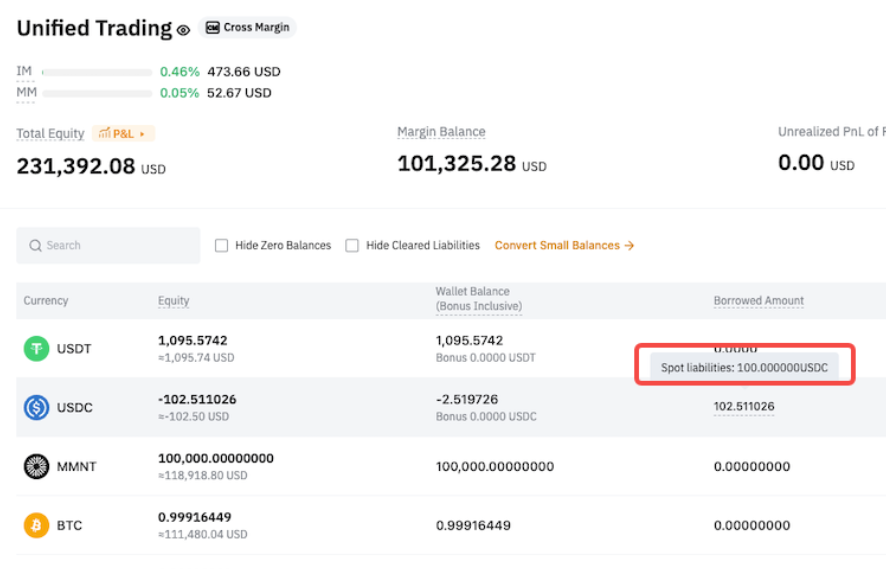

Example Borrowed amount = 100.711451

After transferring in USDC, all liabilities are repaid automatically. - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 0

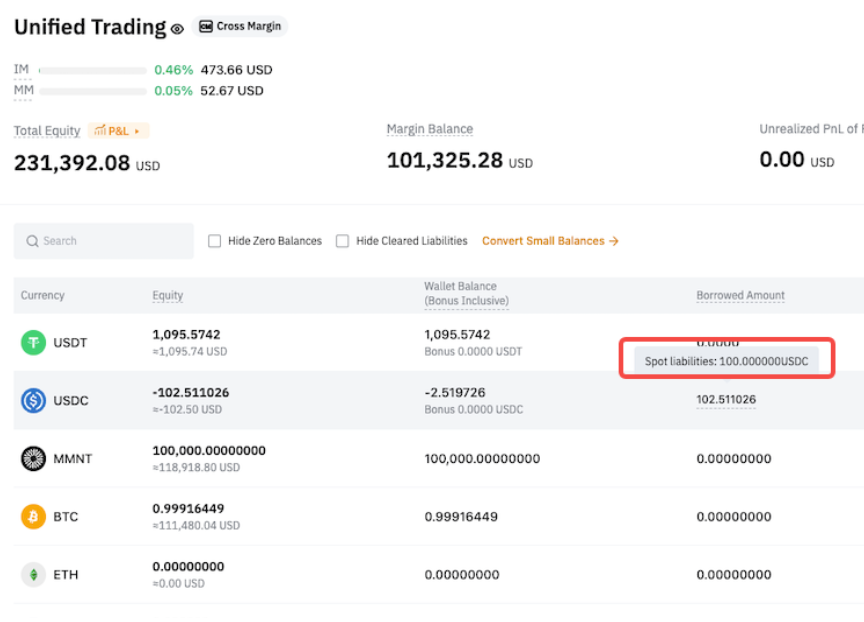

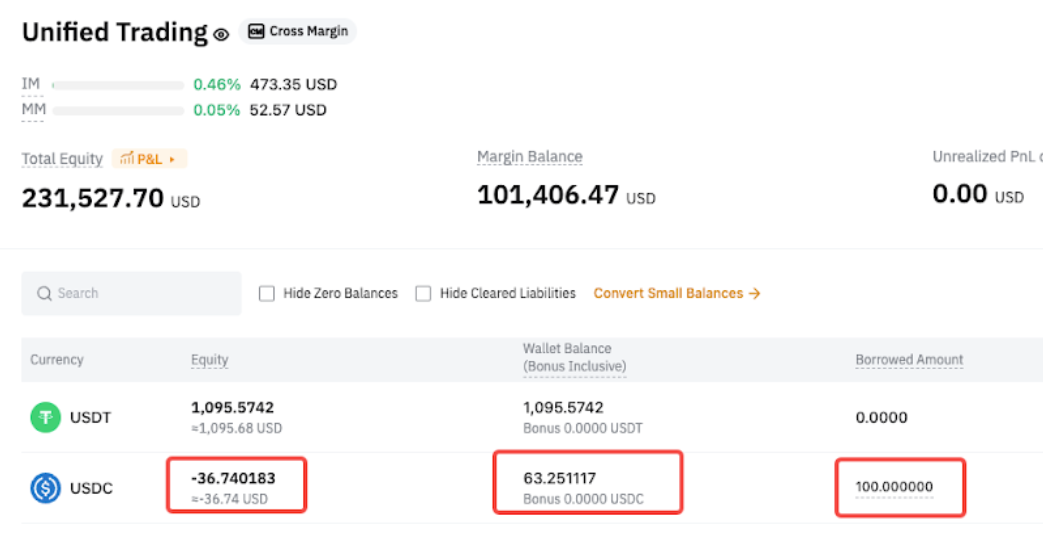

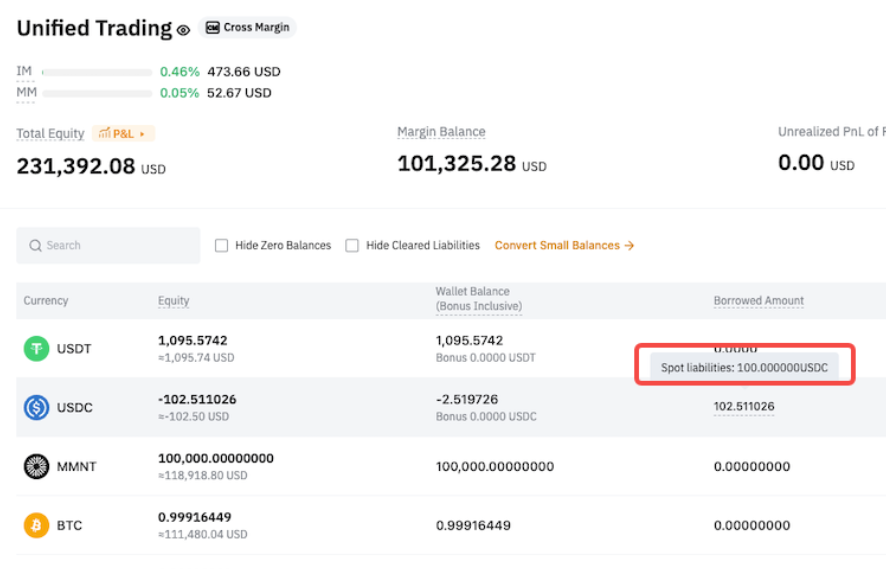

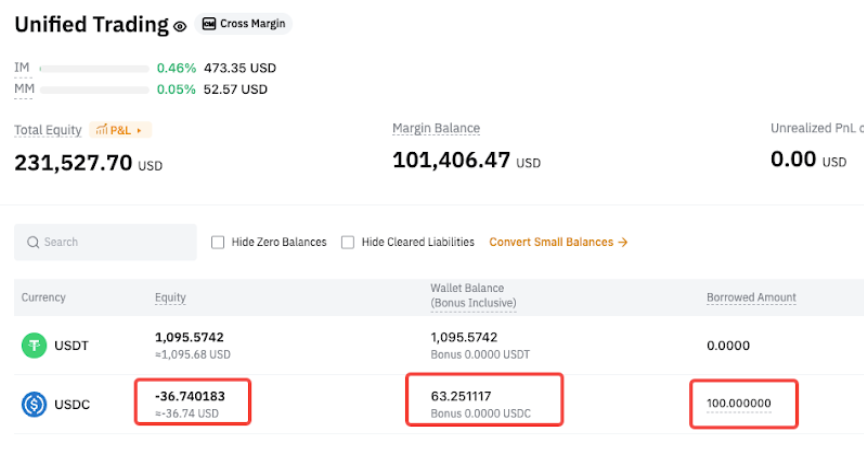

| Example Total borrowed amount = 102.511026 - Spot liabilities = 100

- Derivatives liabilities = 2.511026

After transferring in USDC, only Derivatives liabilities are repaid automatically, while Spot liabilities remain unpaid. - Spot liabilities = 100

- USDC equity = -36.740183

- USDC wallet balance = 63.25117

- USDC borrowed amount = 100

|

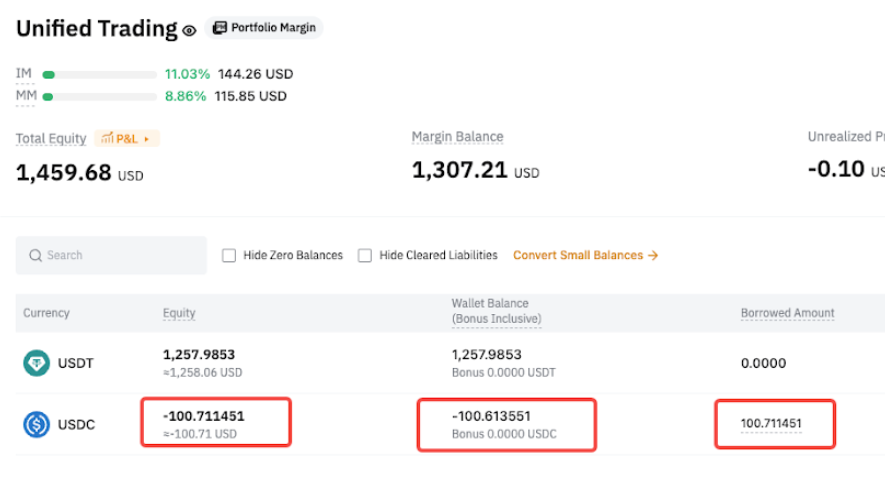

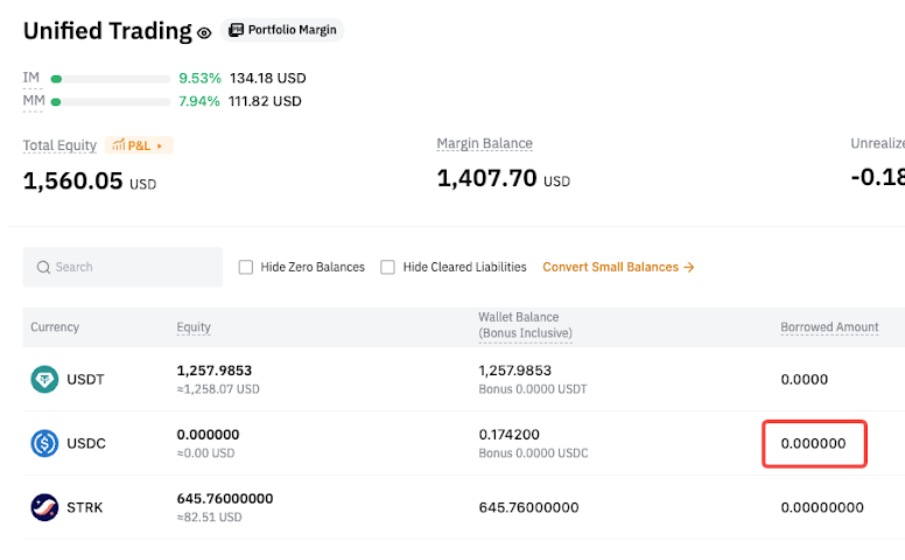

Repayment by Spot Trading

For example, if you borrowed BTC but don't currently hold any, buying BTC with USDT via the BTC/USDT Spot pair will automatically count as a repayment. The BTC you receive is treated as if it were transferred into your Unified Trading Account.

Before Upgrade | After Upgrade |

Transfer-in coins are used to repay both Spot and Derivatives liabilities. | Transfer-in coins are used to repay Derivatives liabilities only. Spot liabilities remain outstanding and must be repaid manually. |

Example Borrowed amount = 100.711451

After transferring in USDC, all liabilities are repaid automatically. - USDC equity = 0

- USDC wallet balance = 0

- USDC borrowed amount = 0

| Example Total borrowed amount = 102.511026 - Spot liabilities = 100

- Derivatives liabilities = 2.511026

After transferring in USDC, only Derivatives liabilities are repaid automatically, while Spot liabilities remain unpaid. - Spot liabilities = 100

- USDC equity = -36.740183

- USDC wallet balance = 63.25117

- USDC borrowed amount = 100

|

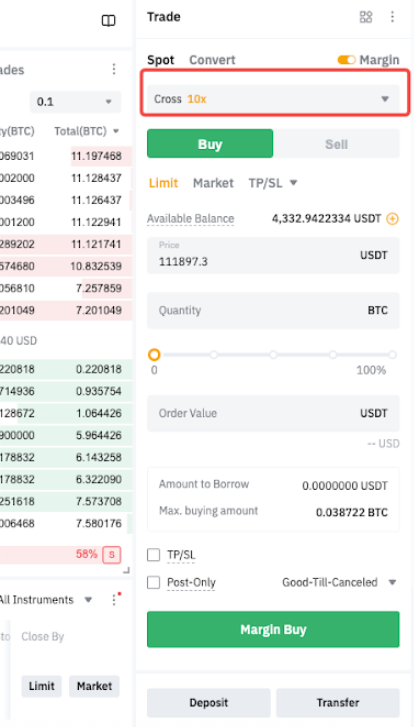

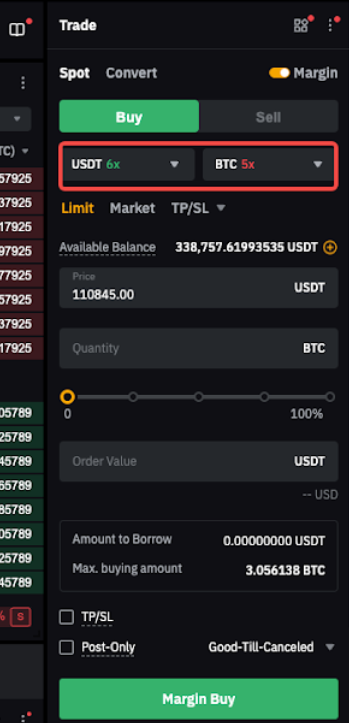

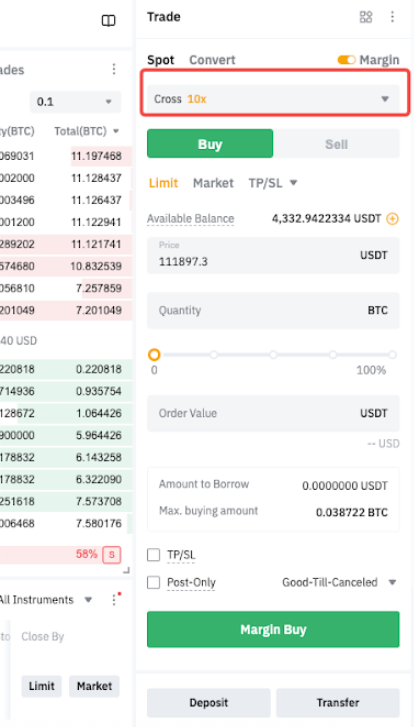

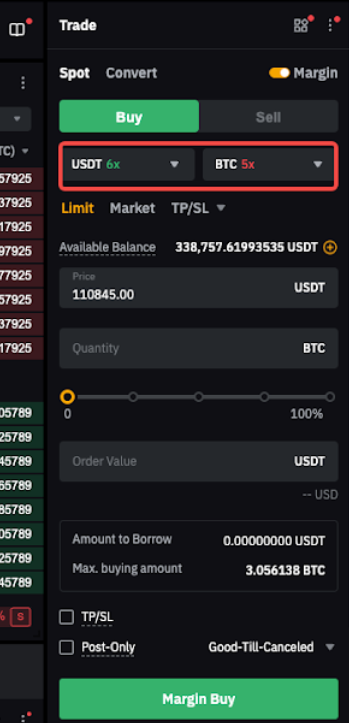

Leverage and Maintenance Margin Rate (MMR)

| Before Upgrade | After Upgrade |

Leverage for Borrowing | Applied to all trading pairs. Maximum leverage is 10x for all pairs.

| Leverage is coin-based, with maximum leverage varying by coin and position tier.

Position tiers are determined by your borrowed amount for each coin. For more details, please refer to here.

|

MMR for Borrowed Amount | Fixed at 4% | Tiered MMR based on coin and position tier.

Position tiers are determined by your borrowed amount for each coin. For more details, please refer to here.

|

API

Feature | Before Upgrade | After Upgrade |

Manual Borrow | Not supported | POST /v5/account/borrow |

Repayment | Only full single-coin repayment is supported, or you can repay all by converting collateral assets. | The system will use any available borrowed coin first, then convert collateral to repay remaining liabilities.

An additional endpoint will be added to allow full or partial repayment. |

Leverage Settings for Spot Margin Trading | Supported. Leverage settings apply to all coins. | Supported. Leverage settings are coin-based. |

Maximum Borrowable Amount Query | Not supported | GET /v5/spot-margin-trade/max-borrowable |

Position Tiers Query | Not supported | GET /v5/spot-margin-trade/position-tiers |

Available Borrowing Coin Query | Not supported | GET /v5/spot-margin-trade/repayment-available-amount |

Maximum Leverage per Coin Query | Not supported | GET /v5/spot-margin-trade/coinstate |