Bybit x DBS Custody Services provides institutional-grade custody solutions that allow institutional clients to use USD deposits held with DBS Bank as collateral for borrowing and trading on Bybit. This arrangement enables access to Bybit's ecosystem while keeping assets under the independent custody of DBS, providing greater capital efficiency and an additional layer of security.

Benefits of the Custody Services

- Improved capital efficiency: Use USD assets held with DBS as collateral to trade across Spot and Derivatives seamlessly on Bybit, with up to 10x leverage available for Margin Trading.

- Greater peace of mind: Keep assets off-exchange to minimize counterparty risk exposure while maintaining access to Bybit's deep liquidity.

How to Get Started With the Custody Services

1. Ensure that you are a Bybit institutional client.

2. Open a custody account with DBS and deposit USD into your DBS custody account.

3. Contact your Relationship Manager (RM) to set up a custody account with Bybit and sign the Bybit x DBS Custody Services agreement.

How the Custody Services Work

Deposit

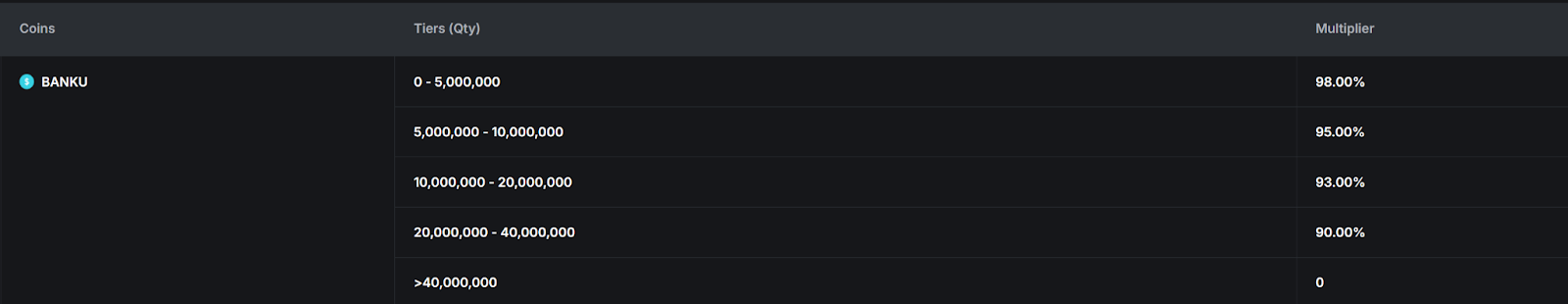

Once the setup is complete, provide your RM with details of your DBS custody account balance and request to use it as collateral on Bybit. After verification, your USD deposits held with DBS will be mirrored in your Unified Trading Account (UTA) as BANKU at a 1:1 ratio and can be used as collateral for Spot, Margin and Derivatives trading, as well as loan services. The collateral value ratio for BANKU is listed here.

BANKU is a mirrored representation of your USD balance used solely for collateral purposes. It cannot be deposited, transferred, withdrawn, or used for Institutional Loans, and it does not have any Spot trading pairs.

To use your USD deposits with DBS as collateral, you must also maintain crypto assets worth at least 15% of the USD deposit value in your UTA. For example, to use $1,000,000 in USD deposits as collateral, you must hold at least $150,000 worth of supported crypto assets in your UTA. Supported crypto assets include USDT, USDC, BTC, ETH, XRP, SOL, MNT, TRX, DOGE, ADA and BNB.

Withdrawal

To withdraw USD deposits used as collateral, please contact your RM to deduct the corresponding BANKU amount from your UTA first. The maximum withdrawable BANKU amount is calculated as your total BANKU balance minus the portion currently used as collateral. Once deducted, you may request to withdraw your USD deposits from DBS.

Note: While BANKU itself is non-transferable, any crypto profits generated from trading using BANKU as collateral may be transferred or withdrawn as usual.

Liquidation & Settlement

In the event of liquidation, crypto assets held in your UTA will be liquidated before any BANKU is settled. BANKU may be settled in either USDT or USD, depending on your preference. The liquidation process follows the standard UTA liquidation mechanism. For more details, please refer to this article.

Frequently Asked Questions

Who is eligible to use the custody services?

Bybit x DBS Custody Services is designed for Bybit institutional clients who require stronger asset segregation and enhanced risk management. If you are not yet an institutional client, you can apply here.

For more details on Bybit Institutional services, check out this page.

What assets are supported by the custody services?

Currently, only USD deposits held with DBS can be used as collateral on Bybit. Support for additional assets, such as government bonds, may be added in the future. Please stay tuned for updates.

Why can't I see a BANKU balance in my UTA corresponding to my USD deposits held with DBS?

This may occur if the supported crypto assets in your UTA are worth less than 15% of the USD deposit value. Please ensure you maintain sufficient crypto assets in your UTA. If you need any other assistance, please contact your RM.

Why is the amount of crypto I can withdraw lower than my UTA transferable amount?

To continue using your USD deposits as collateral, you must maintain crypto assets worth at least 15% of the USD deposit value in your UTA. Therefore, the maximum amount you can withdraw is the lower of the following:

- Your UTA transferable amount; or

- Your crypto balance in the UTA, after deducting the required 15% threshold.